🚀 Could This Crypto Stock Deliver +100% in 2024?

Institutional Crypto Research Written by Experts

We specialize in delivering top-tier research at the crossroads of digital assets and financial markets. Our institutional-grade research stands out for its actionable insights that frequently lead to profitable outcomes for our readers.

10x Research offers three distinct services:

1) newsletter,

2) institutional-grade research, and

3) research services for institutions.

Are you a subscriber to either 1) newsletter or 2) institutional-grade research? If not then you are missing out.

👇 1) Some use the term ‘digital assets’ interchangeably for cryptocurrencies, but the correct definition is that digital assets comprise three building blocks: 1) cryptocurrencies, 2) security tokens, and 3) crypto securities.

👇 2) While we tend to focus on cryptocurrencies, we focus on understanding the crypto market structure and finding opportunities to make money. There is no need for another newsletter telling you to hold onto your Bitcoin forever. Instead, the market is cyclical, and great fortunes must be made, in our view.

👇 3) During the last few months, we developed many (investable) ideas around ‘crypto securities (#3 in the list of ‘digital assets’). This might be a relative niche area of the market, but when the financial markets wake up to the moves of Bitcoin - as occurred on March 30, 2023, when we revealed a portfolio with +112% upside, great fortunes can be made. Three months later, the portfolio of Bitcoin mining companies was up +63%, and we suggested taking profit.

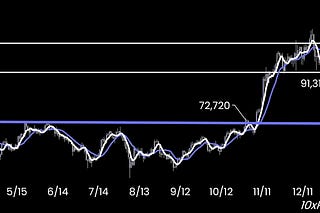

👇 4) Then, on September 28, we re-ran our regression models, and a significant upside opportunity presented itself as Bitcoin prices rose while investors had forgotten about those stocks. Marathon has rallied +148% and Galaxy +94% since then.

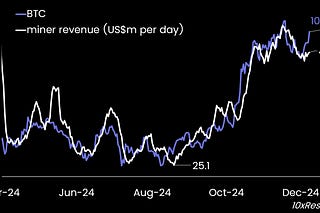

Exbibit 1: Bitcoin Miners index (avg.) vs. Bitcoin - year-to-date performance

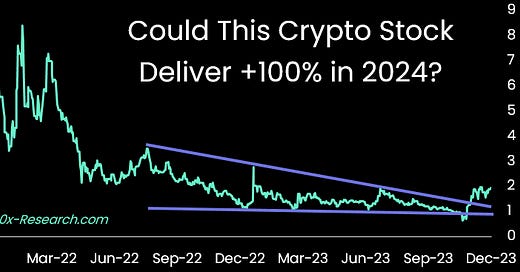

👇 5) On October 26, we looked into Bitdeer, which sold off despite Bitcoin rallying. The reason: The employee shared lock-up after the listing six months ago. The numbers were unbelievable. At the top of 2021, Bitdeer tried to list for $4bn, which was renegotiated to $1.2bn for the April 2023 listing. Then the stock dropped another -75-80% from $10 to $3.1 despite Bitcoin +16% higher since the April listing.

👇 6) Bitdeer closed at $7.79 last night - or +151% since October 26. But the stock is still cheap relative to the Bitcoin price. Nevertheless, at one point, there is time to make a profit. Luckily, many of our subscribers bought these mining stocks at lower levels.

👇 7) We sent our subscribers another idea a week ago: Bakkt Holdings. The stock traded at $1.58 on December 12 when we sent our report. Last night, the stock closed at $1.95 - or +23% in just a week. These stocks are not without risk, but the risk/reward sometimes looks attractive.

Exbibit 2: Bakkt Holdings - a little-known crypto company with potential?

👇 8) Bakkt is a stock that could go down 30% but double or triple. If the Bitcoin bull market continues in 2024 and US institutional digital adoption takes a step forward, this stock could be a key beneficiary.

From our December 12 report (if you are not on the distribution list, please subscribe):

👇 9) The market cap is just $434m. A two-year price comparison would see the stock closer to $5-6, instead of just $1.58. Established in 2018, Bakkt Holdings operates within the digital asset and cryptocurrency space. Founded by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE) – with ICE maintaining a 65% economic interest in Bakkt – the company primarily provides institutional-grade infrastructure and services for digital assets, prominently Bitcoin.

👇 10) Bakkt's offerings extend to software-as-a-service (SaaS) and application programming interface (API) solutions. These enable businesses to deliver cryptocurrency and loyalty experiences, including institutional-grade custody, trading, and onramp services.

👇 11) A key initiative by Bakkt involves launching physically-settled Bitcoin futures contracts. In contrast to cash-settled futures contracts, which involve settlement in cash, physically-settled futures necessitate the actual delivery of the underlying asset, in this case, Bitcoin.

👇 12) Notably, Bakkt's strategic move in November 2022 involved the acquisition of Apex Crypto, an integrated crypto trading platform based in Chicago, from Apex Fintech Solutions. This strategic move positions Bakkt for potential success, especially if the regulated and compliant institutional-grade adoption of Bitcoin advances in the United States in 2024. A physically settled Bitcoin spot ETF could prove crucial in this context and potentially contribute to Bakkt's success within the evolving landscape.

👇 13) This stock’s current valuation appears compelling – despite its loss-making business. We consider the potential approval of a Bitcoin spot ETF, which could significantly benefit the stock. We are committed to conducting further analysis and research on this particular stock, as it presents an alternative avenue for capitalizing on the prevailing crypto bull market in 2024.