Bitcoin -5%. Why Understanding Macro Risks Is Crucial for Bitcoin Right Now

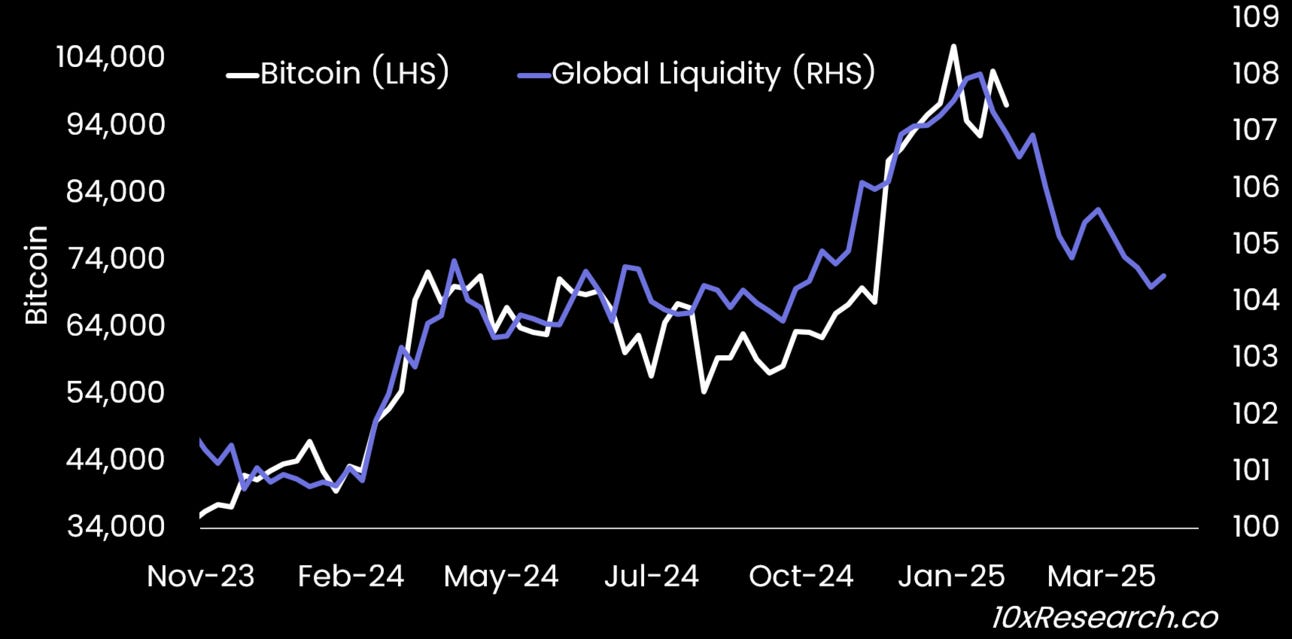

Global Liquidity and Inflation Are Driving Bitcoin.

👇1-14) While numerous factors influence Bitcoin's price, understanding macroeconomic data remains crucial for accurately predicting its direction. In September, the Federal Reserve cut interest rates in response to employment concerns. However, the minutes from that meeting, released in early October, revealed a divided FOMC committee. Our October 10 report noted: “The less aggressive rate-cut trajectory reflects a more resilient economy, as evidenced by robust U.S. labor market data and concerns that a Trump presidency could overstimulate the economy, prompting the Fed to keep rates elevated as a counterbalance.”

👇2-14) This scenario is now playing out, highlighting the critical role of macroeconomic data in shaping Bitcoin's trajectory. In our November 26 Trading Strategy report, “Slipping in the Banana Zone,” we cautioned that global liquidity was nearing a (bearish) tipping point, shifting from a tailwind to a potential headwind as liquidity expansion began to contract. This was yet another key macro data signal.

Bitcoin (LHS) vs. Global Liquidity (RHS, $ trillions)

👇3-14) While Bitcoin’s relationship with global liquidity is not strictly linear, the strengthening of the US dollar and the rise in US bond yields have been clear manifestations of these emerging headwinds. These pressures have only intensified since the December FOMC meeting, further underscoring the importance of monitoring macroeconomic trends. Below, we provide an updated tactical roadmap to help navigate these risks effectively.