Smart Bitcoin Traders Rely on These 3 Key Indicators to Stay Profitable $$$

These three indicators now matter the most for successful traders.

If you no longer wish to receive our email reports, please click the unsubscribe link below (at the bottom).

👇1-14) Our expertise in understanding interest rate policy, analyzing market structures like flows, developing proprietary quantitative models, and applying technical analysis has given us a significant edge over the years in the crypto space. Drawing on experience managing capital for some of the largest hedge funds, we’ve honed the ability to discern when to take bold bets and adopt a more conservative approach. Knowing when the probabilities are in your favor is critical—but so is independent thinking.

👇2-14) On December 9, we published 'Is Bitcoin Entering the Death Zone?' and 'Navigating Bitcoin's 'Death Zone': Risks, Consolidation, and the Path to the Summit' on December 10. In these reports, we cautioned that only the strongest assets would continue to perform and warned that the "air was getting thinner," signaling elevated risks and potential consolidation ahead. Many altcoins, such as ETH, XRP, and SOL, peaked during this period, while Bitcoin continued its rally for another week. Although strongly bullish in late September, we began to issue cautionary signals by early December.

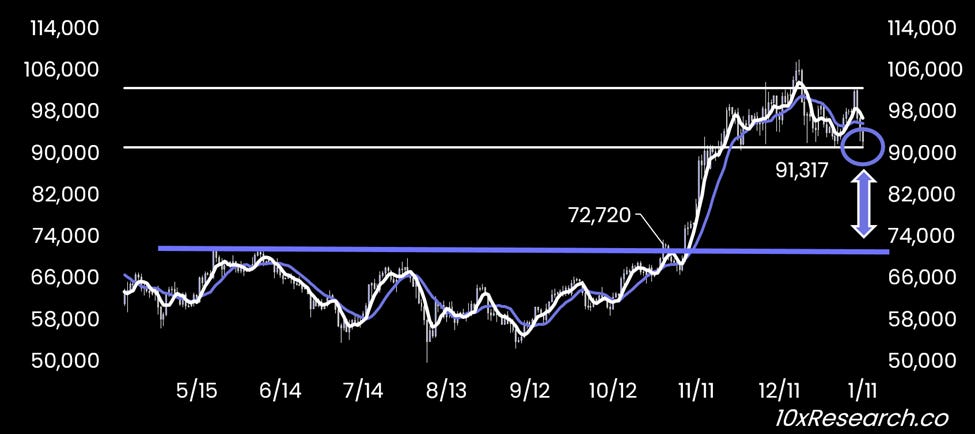

Bitcoin is sitting on technical support.

👇3-14) Three key factors have prompted our cautious stance on Bitcoin.