Would Traders Have Bought Bitcoin if They Knew This?

Institutional Crypto Research Written by Experts

👇1-12) In October 2022, we predicted that Bitcoin would rally toward $63,000 ahead of the 2024 halving, based on our ‘diminishing cycle returns’ model, which has proven more accurate than the widely accepted 4-year Bitcoin cycle. As more people are starting to realize, the traditional 4-year cycle is becoming less reliable, and the stock-to-flow model has lost much of its predictive power. While this may surprise some, we have highlighted these shifts for months (see our May 9 report).

👇2-12) It's well-known that Bitcoin experiences significant drawdowns, or "crypto winters," and understanding the reasons behind this cyclicality and what drives it can be crucial for making or losing money in crypto. Technical reversal indicators warn of potential deeper corrections when Bitcoin's momentum fades after parabolic moves. That's why we've repeatedly emphasized the importance of taking profits and protecting capital at the $68,300 level. There will always be opportunities to ride the next wave.

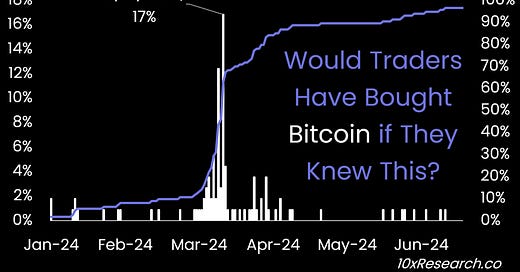

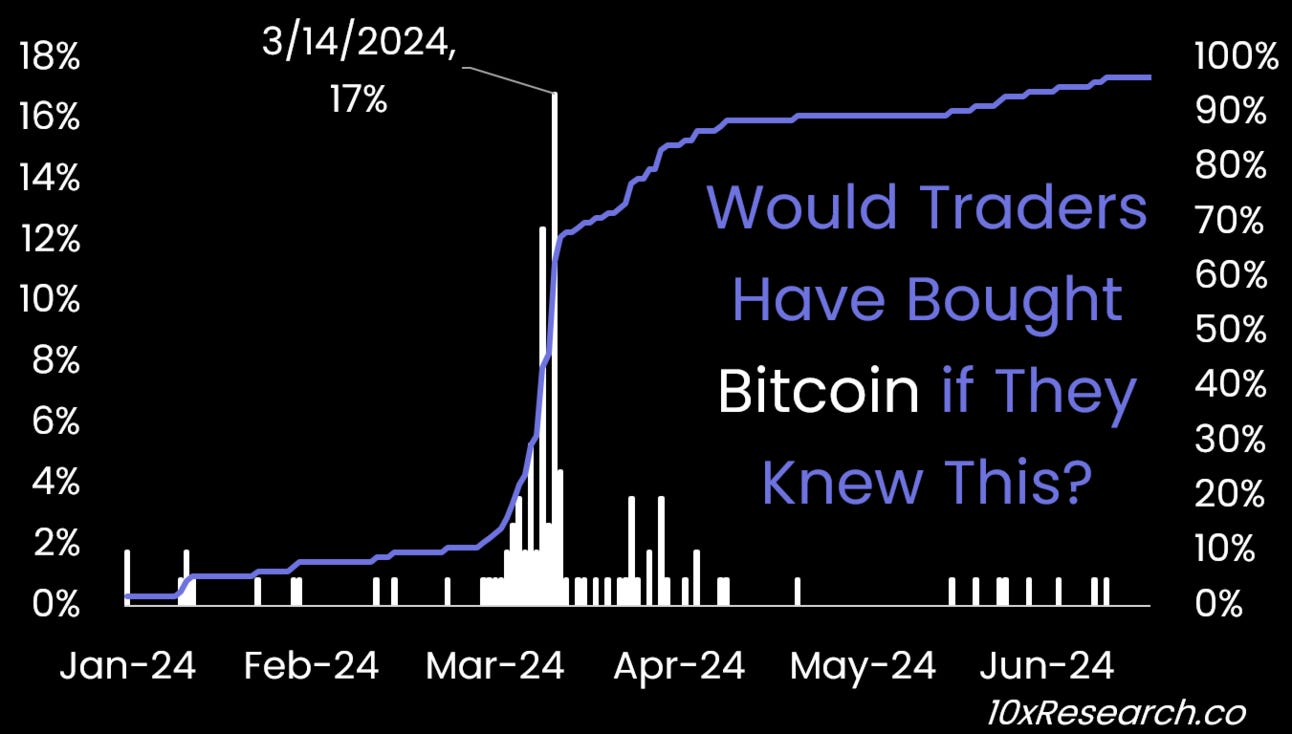

Nearly 60% of altcoins peaked in March, 80% by April, 90% by May.

👇3-12) Since June 19, we have cautioned 'The Altcoin Bear Market: A Harsh Reality for Most Traders.' Bitcoin has held up better because savvy traders have quietly converted their altcoins with weak tokenomics (such as those facing massive unlocks) into Bitcoin—though they wouldn't openly acknowledge this on Twitter. Meanwhile, many investors who purchased Bitcoin (and other cryptocurrencies) at elevated prices are now at risk of liquidation. In crypto, having the correct information is crucial for making smart decisions.