Will 2025 Be the Year Ethereum Finally Takes Off?

👇1-15) While we appreciate Ethereum's occasional rallies and crashes, as volatility creates opportunities, 2024 has raised serious questions about Ethereum's value proposition. Competing chains and protocols have increasingly outperformed Ethereum, challenging its dominance. Remember the term "ETH flippening BTC" that gained traction during the 2020/2021 bull market?

👇2-15) Additionally, concerns have emerged about the commitment and focus of Ethereum's leadership in advancing its mission to provide a decentralized platform for building and deploying smart contracts and decentralized applications (dApps), which aims to foster innovation and economic freedom.

👇3-15) The three major Ethereum catalysts of 2024 have largely fallen flat, adding little value overall. The Dencun upgrade in March arrived six months too late, missing the peak of the meme coin craze, which had already shifted to the more cost-effective Solana alternative.

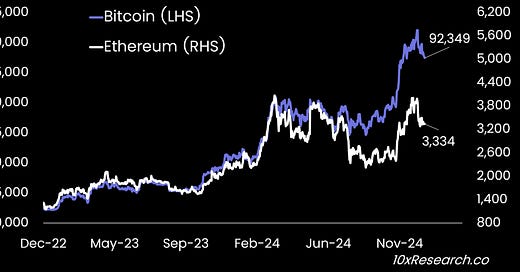

Bitcoin (LHS) vs. Ethereum (RHS)

👇4-15) Similarly, the launch of Ethereum ETFs in July delivered underwhelming inflows. While Bitcoin's +120% return in 2024 managed to pull Ethereum upward to some extent, Ethereum’s +48% performance—representing a staggering 70% underperformance relative to Bitcoin—is telling, especially for an asset typically regarded as higher beta.

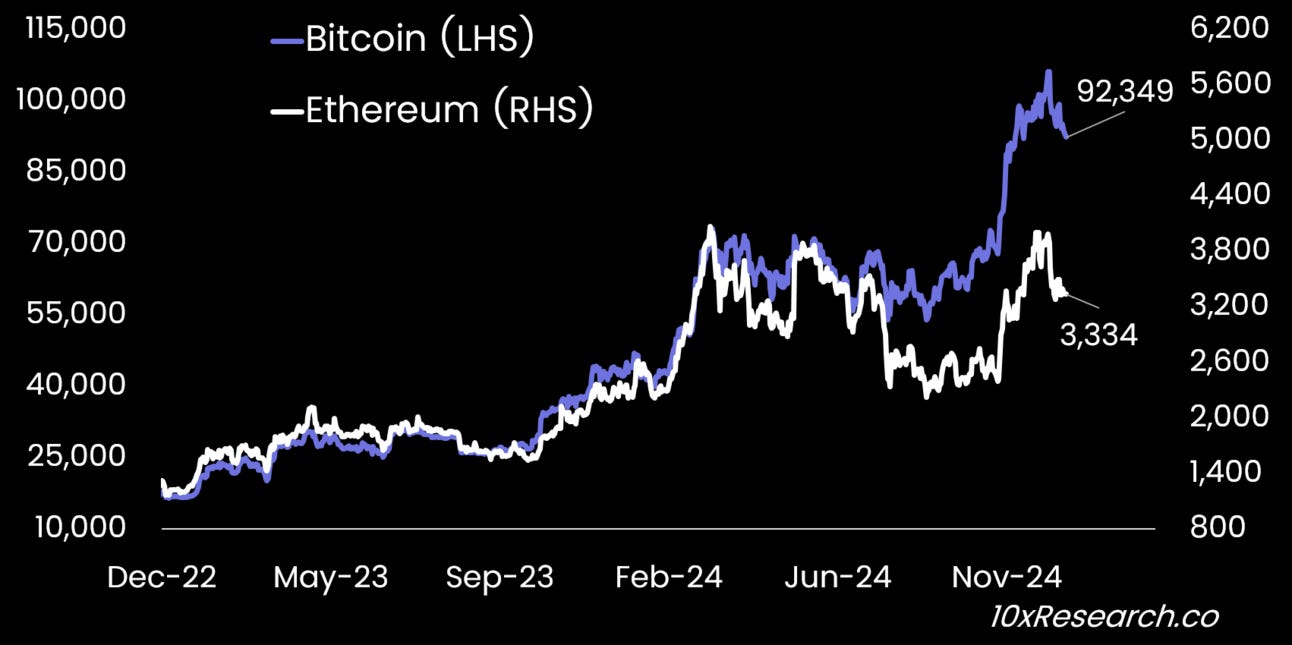

👇5-15) Surprise, surprise—another incremental Ethereum upgrade is on the horizon for 2025. We have often criticized these upgrades as largely superficial, creating the illusion that Ethereum is shaping the future of crypto. Our skepticism remains. Of the 19 upgrades so far, only two have had a notable positive impact on price, and even those occurred during Bitcoin bull markets. The November 2016 upgrade addressed critical security concerns, and the October 2020 upgrade introduced staking, both of which were significant. However, the other upgrades have added little in terms of meaningful impact.

Ethereum ICO and the subsequent upgrades (ETH price after those)

👇6-15) While some have touted Ethereum staking yields as the foundation for viable crypto interest rate curves, we have long criticized the relentless demand for staking following the September 2022 transition from proof of work to proof of stake. This demand, in our view, reflects a deeper issue: Ethereum is no longer (or less and less) being actively utilized for DeFi or other crypto activities.

👇7-15) Instead, it has become akin to a deposit account, where ICO-era holders passively collect staking yields. These yields have not only become uncompetitive compared to TradFi interest rates but have also contributed to Ethereum’s significant underperformance relative to Bitcoin, with no clear signs of reversal. 28% of all ETH is being staked.

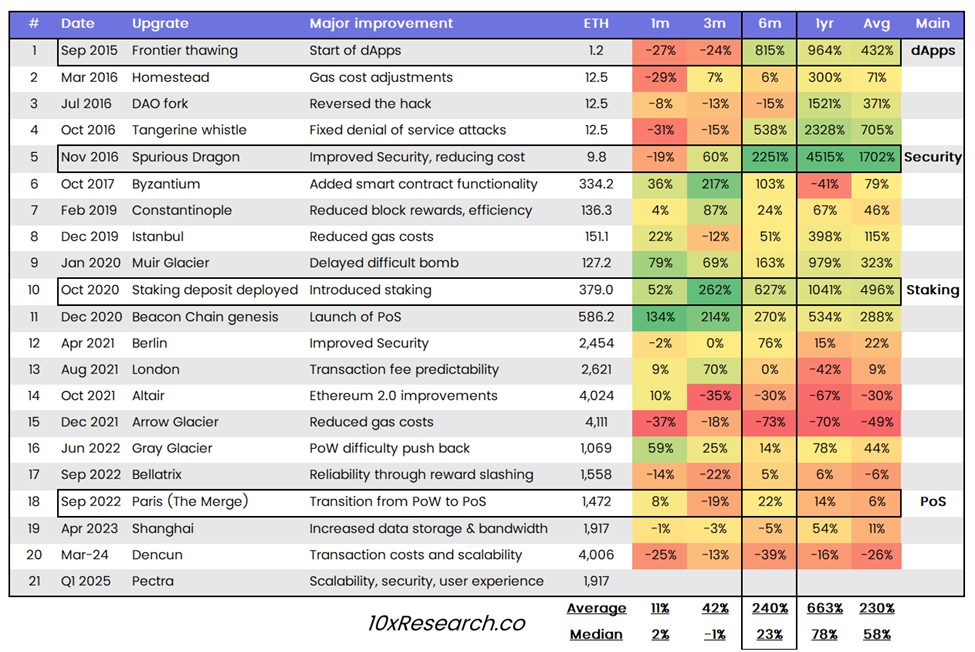

👇8-15) The bullish narrative following the Dencun upgrade was that transaction fees would drop to just 10% of their previous levels, unlocking the potential for new use cases to be built on Ethereum. Just as lower streaming costs enabled Netflix to thrive and cheaper batteries fueled Tesla's growth, reduced Ethereum gas fees were expected to catalyze the development of micro-payments and a surge in DeFi protocols. However, the reality has fallen short of expectations. Activity remains stagnant, and Ethereum is increasingly losing ground to Tron as the preferred chain for stablecoin issuance.

👇9-15) Weekly Ethereum transactions peaked at 11 million in May 2021 and have largely remained stagnant since, currently standing at 9 million—up slightly from 8 million in September 2024. Similarly, active weekly addresses have been range-bound between 300,000 and 400,000, also peaking in May 2021. This stagnation in user activity contrasts sharply with the growth seen in other alternative blockchains, underscoring a noticeable lack of user interest in the Ethereum ecosystem since its peak.

Ethereum (LHS) vs. Fees (RHS, $ million)

👇10-15) Before the March 2024 Dencun upgrade, Ethereum’s price often correlated closely with the fees generated by its ecosystem—the more activity, the higher the fees users paid. While this relationship should still hold, the adjustment has been sluggish, partly due to the ETF launch catalyst and the persistence of whale holders. However, we remain skeptical that a new wave of investors will buy Ethereum in significant volumes, as its current price appears overvalued relative to the fees being generated. While the outlook could always shift, we remain cautious and not overly optimistic about Ethereum’s prospects at this stage.

👇11-15) Since the September 2022 Merge, Ethereum’s staking yield has dropped from 5.5% to just 3.0% (or lower, Coinbase offers 1.99% APY). Despite promises of "ultrasound money," where more ETH would be burned than issued, this hasn’t materialized meaningfully. Over the past two years, 1.91 million ETH has been burned compared to 1.85 million ETH issued—a negligible net difference (perhaps what Vitalik spends on hippo conservation in Thailand). Far from being "ultrasound," Ethereum has become "ultraboring."

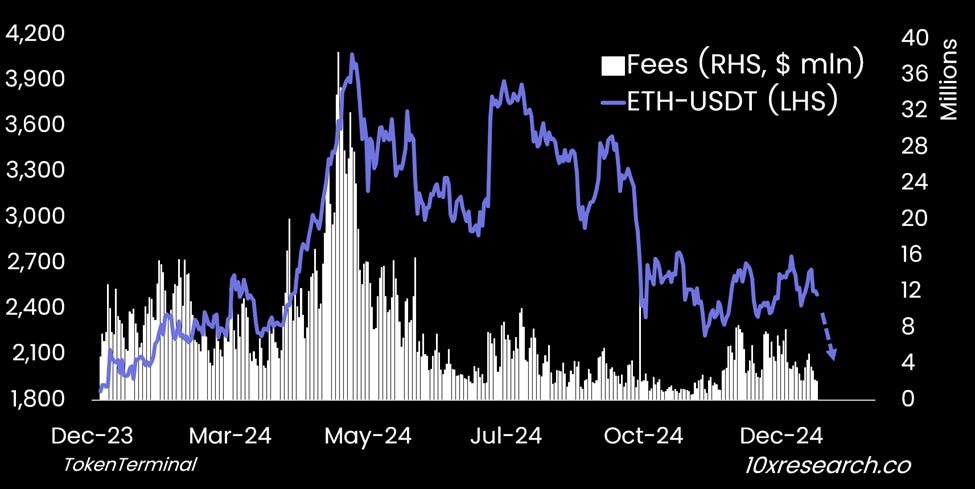

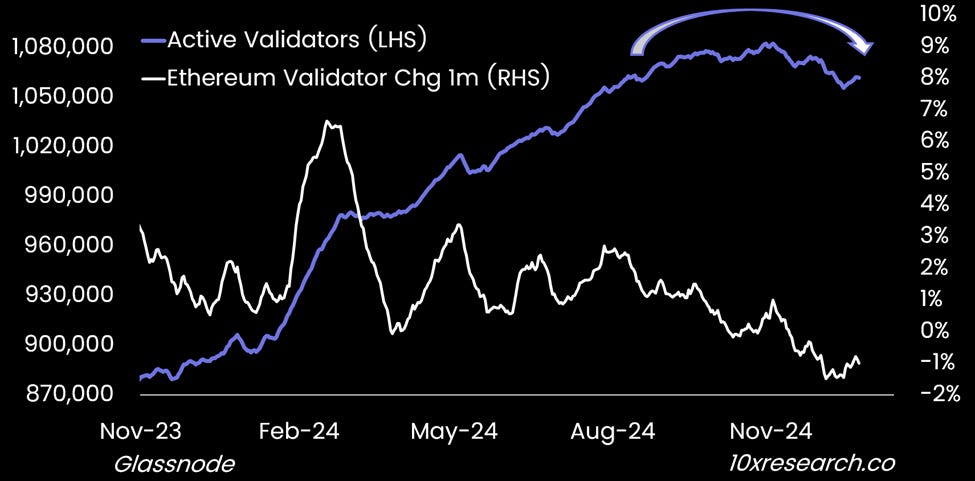

👇12-15) Looking ahead to 2025, the most important metric for Ethereum will be the trend in active validators. With the 1-month growth rate of validators turning negative, there’s a growing risk that some validators may begin exiting the network. If unstaking accelerates, it could put additional downward pressure on ETH prices.

Ethereum Active Validators (LHS) vs. 1 month Change in Validators (RHS)

👇13-15) This shift seems logical, given Ethereum’s lack of real demand outside of staking. Staking yields are 200 basis points lower than Treasury yields, and Ethereum has dramatically underperformed Bitcoin—by 70% in 2024 and 65% in 2023. In this context, a 3% staking yield hardly compensates for such significant underperformance compared to Bitcoin.

👇14-15) We also lack confidence in the margin of safety, as the realized price—the average price at which the entire ETH supply last moved on-chain—sits at $2,093. Meanwhile, the average deposit price for all staked ETH is $2,383, a level ETH briefly dropped below in September. This makes staking ETH for a modest 3% yield (or lower) a tenuous value proposition at best. The risk of validators exiting the network looms large, and 2025 could be the year this unfolds, particularly with no significant catalysts on the horizon for Ethereum.

👇15-15) While we appreciate Ethereum's volatility, we believe it remains a poor medium-term investment and expect ETH to underperform BTC once again in 2025. While the possibility of a new catalyst cannot be ruled out, we wouldn't be surprised if Ethereum struggles to deliver meaningful rallies next year. As a result, our stance on Ethereum remains clear: 'avoid.'