Why a Bitcoin Breakout Is Imminent: Key Reasons to Boost Your Confidence

Looking at the facts from the derivatives markets to on-chain data.

👇1-14) We entered October with a bullish outlook, but, as we had cautioned for the past three months, the first week of the month often brings a market correction. True to form, Bitcoin experienced a sell-off earlier this month.

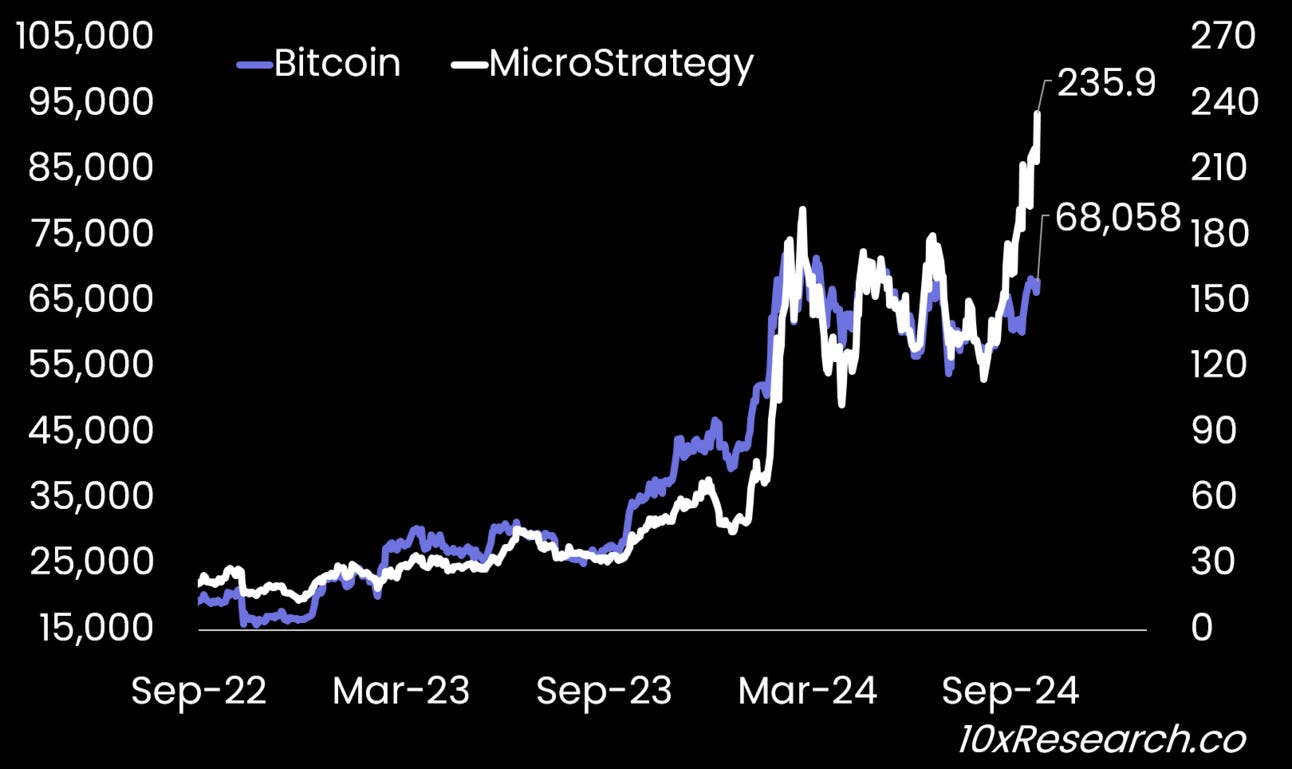

👇2-14) On October 7, we released an update titled "Doubling Down on Bitcoin’s October Rally as MicroStrategy Shares Could Break Out." With central banks like the Swiss National Bank and Norway’s Sovereign Wealth Fund investing hundreds of millions of dollars in MicroStrategy shares as a proxy for Bitcoin, we anticipated a potential breakout for MicroStrategy. This, in turn, could trigger a "tail-wagging-the-dog" effect, driving Bitcoin’s momentum.

MicroStrategy (RHS) might have the power to pull Bitcoin (LHS) higher.

👇3-14) On October 7, MicroStrategy shares were trading at just $177, but they have since climbed to $236, marking a 33% increase. This rally is significantly influencing Bitcoin’s upward momentum. Yesterday's report emphasized Bitcoin’s retest of the crucial $66,500 level—a critical technical marker as it served as the September high and a support level.