10x Research is hosting a drinks event conveniently located next to the Token2049 conference. If you’re a subscriber and haven’t registered yet, please use the link at the bottom of this email to sign up!

👇1-12) A sustained Bitcoin rally is only possible with a bullish shift in on-chain data. Is that shift happening? The pros are closely monitoring on-chain data and making their decisions accordingly.

👇2-12) A year ago, Bitcoin reached a critical low during the week of Token2049, dipping to $25,100 before surging over 50% in Q4 to meet our year-end target of $45,000. The technical conditions with a strong track record were nearly perfect, with weekly reversal indicators marking a bottom and on-chain data indicating renewed strength. By late September 2023, our models had identified a breakout for Bitcoin and Ethereum. Bitcoin went on to gain 26% in October, 9% in November, and 14% in December 2023.

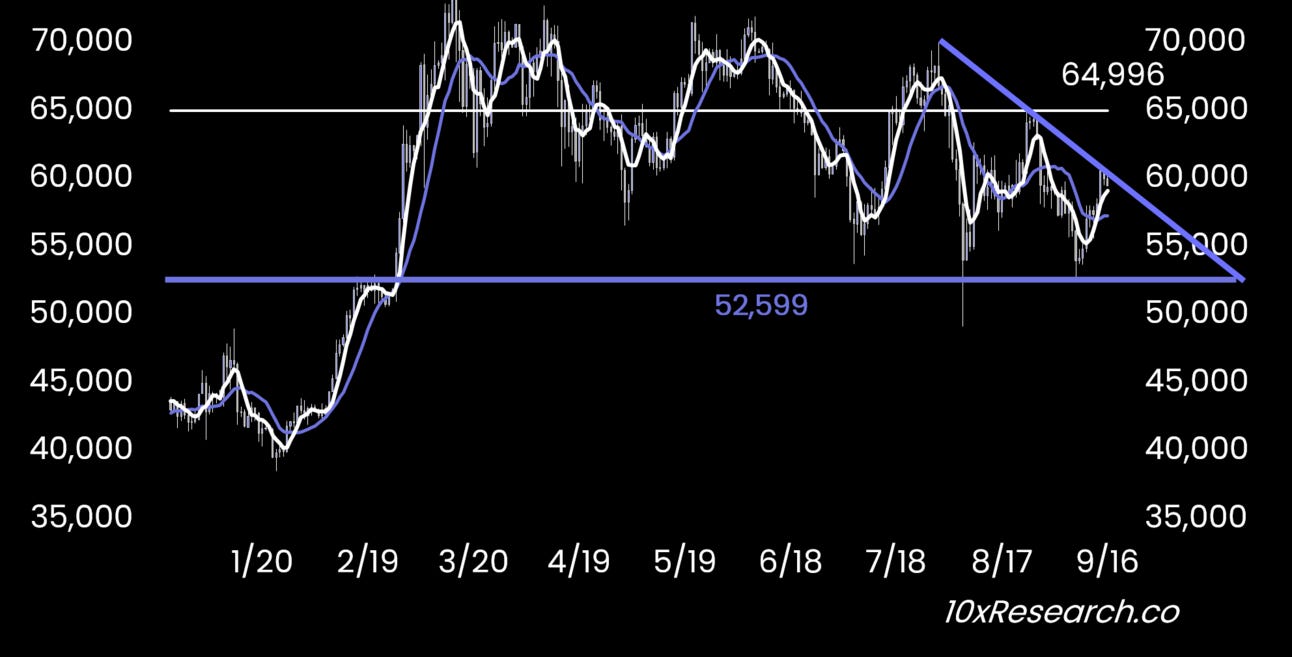

👇3-12) A week ago, we observed that Bitcoin seemed bottoming out from oversold technical levels, supported by our reversal indicators. Our Greed & Fear index had reached extreme fear levels—conditions that have historically triggered price rebounds.

👇4-12) As expected, Bitcoin has surged 10% over the past week, reaching our $60,000 target and positioning itself in the middle of the $50,000 to $70,000 range. The key questions are whether this rebound is sustainable and where Bitcoin might move next.

Bitcoin needs to break above the triangle resistance line.