Follow us on Twitter: https://twitter.com/DeFiOnTarget

👇 1) Chart of the Week: Solana or SOL-USD: jumped by 37% during the last week as news circulated that FTX plans to return 90% of customer funds

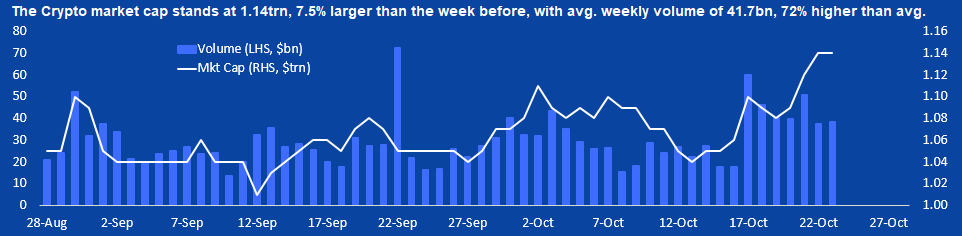

👇 2) The Crypto market cap stands at 1.14trn, 7.5% larger than the week before, with avg. weekly volume of 41.7bn, 72% higher than avg.

👇 3) End of Sep, Bitcoin broke above the downtrend and made a higher low as BTC retested the 50-day moving average on Oct 13; Our Greed & Fear Index @ 97%, while Ethereum's @ 80%. The RSI for Bitcoin is 75% (overbought) while the Ethereum RSI is at 60%; Realized Volatility continues to decline, there is a lack of interest for upside optionality - smart traders switch out of delta into spot

👇 4) Bitcoin's daily volume is 9.9bn, week on week volume is 45% higher, however, volume is declining, expect profit taking in BTC

👇 5) Ethereum's daily volume is 4.5bn, week on week volume is 6% higher, ETH will likely continue to underperform

👇 6) BTC's dominance at 51.3% while BTC volume trades 2.23 higher than ETH

👇 7) BTC/ETH ratio is making a new one-year high as BTC continues to outperform

👇 8) Tether USDT market cap is 84.1bn, 0.7% than a week ago, while volume was 33.3bn, 91% higher than avg. New USDT mints are bullish

👇 9) Top 10 blockchains generated $67.3m in fees during the last week, Tron: 20.1m, Ethereum: 15.6m, Lido Finance: 11m, Uniswap: 7.1m; Top 4 TVL: Lido ($14.6bn): 5.8%, Maker ($7.9bn): 3.5%, AAVE ($5bn): 8.3%, JustLend ($4.8bn): 5.3%, Uniswap ($3.2bn): 4.4% (WoW)

👇 10) Avg. daily Derivatives Volume was $62bn, with Binance mkt share of 49%, Bybit 19%, OKX 16%, Deribit 7%; Avg. daily Spot Volume was $11bn, with Binance mkt share of 54%, KuCoin 8%, Coinbase 8%, Bitstamp 7%

Follow us on Twitter: https://twitter.com/DeFiOnTarget

Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets

Purchase a copy on Amazon: https://amzn.to/46r1zwJ

Please leave a review on Amazon if you have not done it yet - many thanks !!