US Institutions account for 85% of Bitcoin buying

Helping EVERYONE to make better crypto investment decisions.

🚩 A few bullet points:

🌎 Telegram updates... https://lnkd.in/gqMMgw5Z

👇 1) For a long time, we had the view that Asia is driven by retail flow while the US is driven by institutional investors.

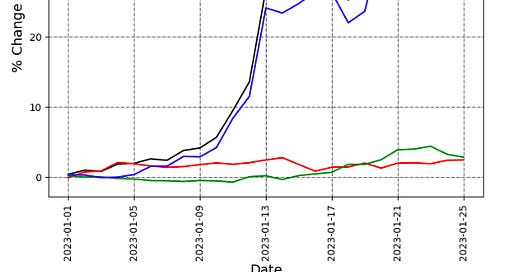

👇 2) Therefore, if an asset that trades 24 hours performs well during US trading hours, that should be a clear indication that US institutions are buying it while if an asset performs well during Asian trading hours, it would mean that Asian retail investors are buying it.

👇 3) Bitcoin is up +40% year-to-date with +35% of those returns occurring during US trading hours. That's an 85% contributions of the rally associated with US based investors. Hence, we interpret this as a clear signal that US institutions are buyers of Bitcoin right now.

Exhibit 1: Breaking down the performance YtD within time zones

👇 4) While there have been several project related news that impacted various token prices (Lido, Aptos, dYdX, etc.), the bulk of the crypto rally only started after US inflation data was released on January 12, 2023. A clear “institutional investors” macro event.

👇 5) Unsurprisingly, the inflation data came in weaker and is now expected to come in weaker for some time. This could set up the crypto market for a mid-month rally, every month and turn into a trend where we see a strong rally from mid-month onwards with some consolidation towards the end of the month as traders take profit and miners sell calls.

👇 6) If history is any guide, this means that first institutions buy Bitcoin to get exposure to the asset class and the next step for them is to switch from Bitcoin to various other tokens.

👇 7) While Ethereum appears to be similarly driven by institutional flows during US hours, Aptos (see our daily report from January 26, 2023) is seeing a mix of strong returns during US trading hours AND during Asia trading hours.

👇 8) Again, if history is any guide, Aptos could rally a lot further as Korean retail traders would start to dominate the flow. The analog is the December 2017 move in Ripple XRP when prices went 10x. Arguably, back then, the story for Ripple was slightly different (and more bullish) than for Aptos but there is no doubt that Korean retail investors are still hungry for eye-watering returns.

👇 9) But institutions are not only buying Bitcoin spot, rather, we are also seeing consistently high premiums for perpetual futures. A sign that traders are willing to overpay to get exposure. We interpret this as an indication that faster institutional traders and hedge funds are actively buying the recent dip in crypto markets.

👇 10) This should be a very positive sign for Bitcoin. Institutional adoption continues.