Traders Monitor 4 Key Catalysts That Could Drive Bitcoin Past $100,000 Before Year-End

This month's parabolic move is well-supported, with $18 billion in liquidity deployed within just one week...

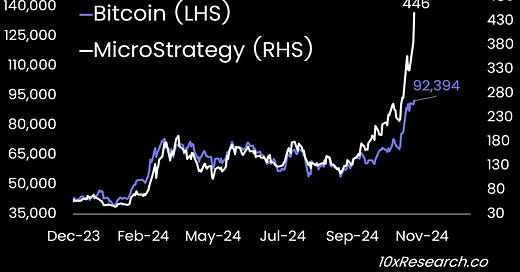

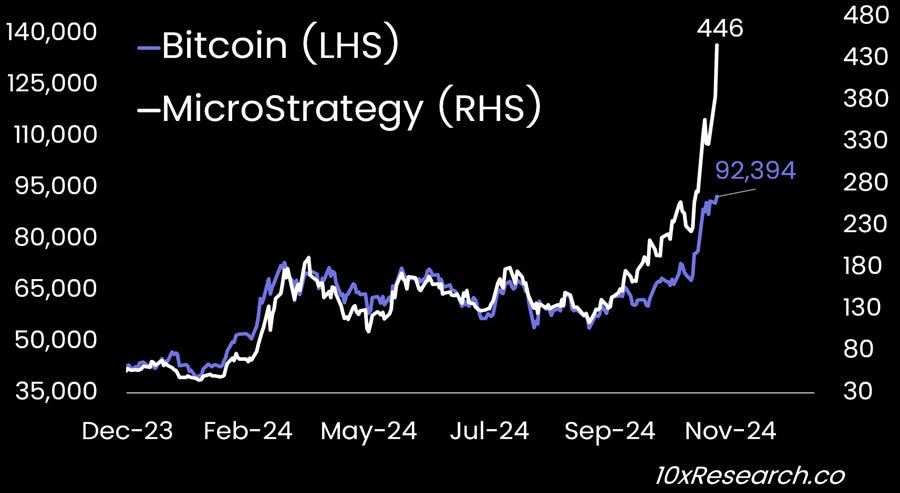

MicroStrategy has surged +140% since our October 6 report, "Doubling Down on Bitcoin’s October Rally as MicroStrategy Shares Could Break Out." With its market capitalization now at $88 billion, it has reached the size of companies like Dell and Palantir (>$80 billion) when they were added to the S&P 500 index and subsequently rose +7% on the announcement in early September 2024.

Our October 14 report highlighted the possibility of MicroStrategy being added to the S&P 500 index on December 6, 2024. Given the substantial short interest in the stock—much of which extends beyond hedging convertible bond notes—a short squeeze could propel its share price even higher. This appears the case currently.

As noted in our previous reports, two key factors could amplify buying pressure on MicroStrategy’s stock. First, the substantial short interest could force short sellers to cover their positions. Although the short base has slightly decreased from 30.7 million shares on September 30 to 28.3 million shares by October 31, it remains significant.

Exhibit 1: Bitcoin (LHS) vs. MicroStrategy (RHS)