Traders Are Asking: Has Ethereum’s Golden Era Come to an End?

Determining ETH's upside potential comes down to 2 data points.

👇1-14) With the U.S. election only a week away, Trump’s odds of winning rapidly increase, making a loss seem less and less likely. Polymarket currently assigns his winning probability at 65.0%. Other sources also show him in the lead: Economist Magazine at 54.0%, Nate Silver's Silver Bulletin at 53.3%, FiveThirtyEight at 52.9%, and RealClearPolitics' betting average rising to 61.3%. Trump also maintains significant leads across all six swing states.

👇2-14) Historically, pre-election polls underestimated Trump’s chances in 2016 and 2020, but he now holds a substantial lead, with many Americans believing the country is on the wrong track under Biden/Harris. Meanwhile, Trump Media’s share price, noted on October 18, has surged +30% over the past week and is up +200% since just after the September FOMC meeting. While these shares and the MAGA Trump token, which rebounded +80%, have rallied, they’ve lagged as the crypto rally becomes increasingly focused on a select few coins and tokens.

👇3-14) While betting on wild narratives can be exciting, most traders lose money. This trend has repeated across cycles: from the 2016/2017 ICO boom to the 2020/21 DeFi summer and NFT craze, and now in the 2023/2024 meme-coin surge. Of the 4.4 million Pumpfun wallets, 56% are currently in losses. Half of the 44% of wallets showing a profit are barely ahead, with gains of less than $1,000. Profits were possible in each cycle, but successful trades required disciplined risk management, like setting stop-losses to secure gains or limiting losses when prices fell below certain levels.

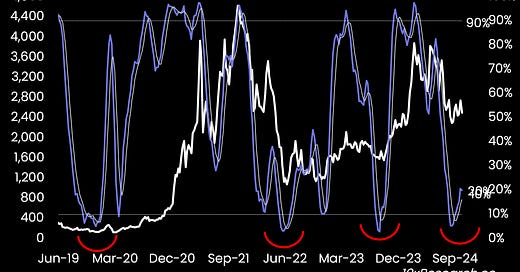

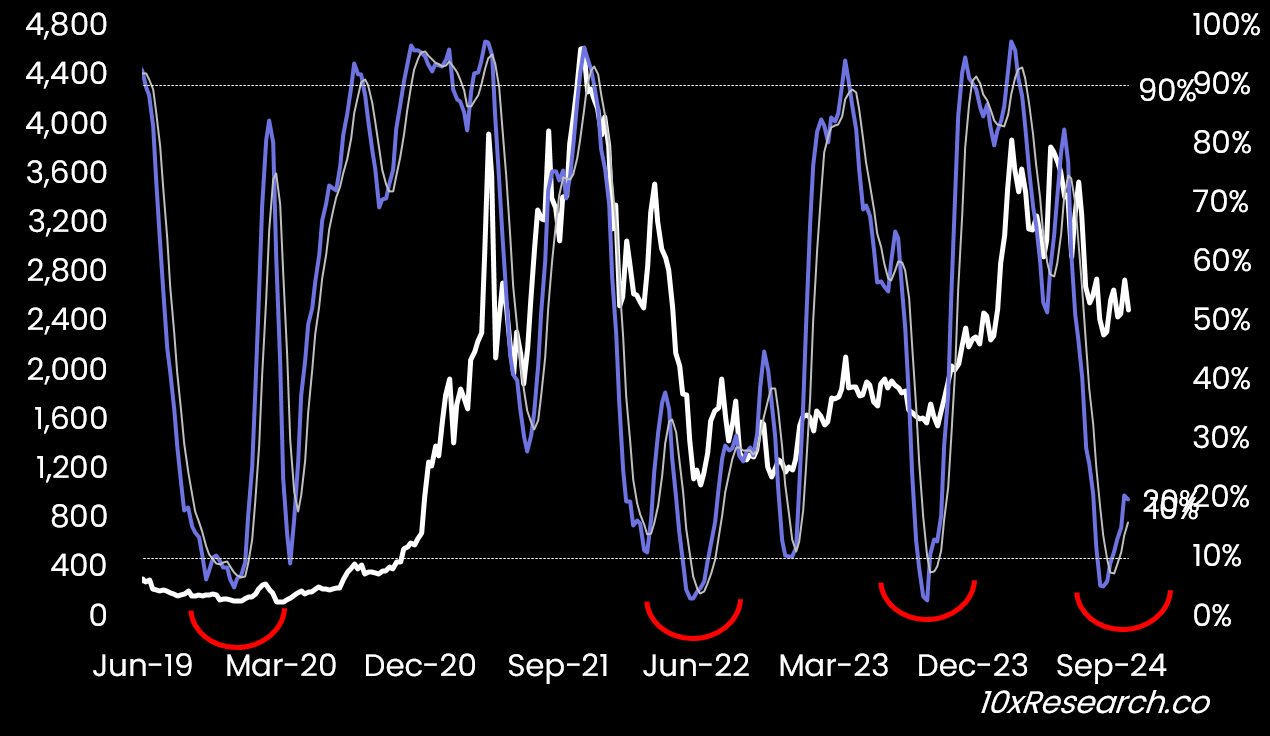

Ethereum - weekly stochastics indicator - major bottom in place?