This ONE Indicator Will Decide If Bitcoin Will Make New All-Time Highs

Institutional Crypto Research Written by Experts

👇1-12) To most people, Bitcoin price moves appear random, but in the following two to three reports (this is the first one), we want to point out Bitcoin's critical drivers. If we get those right, we should also get Bitcoin’s turning point and direction right. It is no coincidence that Bitcoin was weak in January and stronger into March but consolidated for two months.

👇2-12) Bitcoin reached a critical turning point two weeks ago. Retail flows (as measured by volumes in Korea) have remained weak, indicating that retail does not understand what is happening. They will have FOMO. We are confident that Bitcoin will soon reach new all-time highs, and these two to three reports should help convince our readers that this is indeed the case.

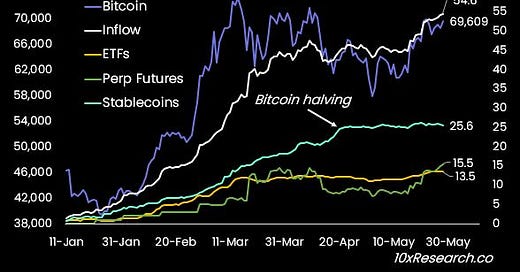

👇3-12) Year-to-date, we have seen $54.6bn of inflows into crypto markets, comprising $25.6bn in stablecoins, $15.5bn of perpetual futures leverage increase, and $13.5bn of Bitcoin Spot ETF inflows. Although this analysis does not capture several minor data points, it shows where most flows came from.

👇4-12) Below, we show when these flows stopped, when they resumed, and why and if those flows will continue. This will be critical in determining Bitcoin’s price direction (up or down).

Bitcoin and various flows (Stablecoins, ETFs, Futures leverage)