The latest developments in Bitcoin, Crypto, and DeFi...

Institutional Crypto Research Written by Experts

If you no longer wish to receive our email reports, please click the unsubscribe link below (at the bottom).

👇1-10) Ethereum developers have announced plans to roll out the Pectra upgrade in March 2025, focusing on introducing account abstraction, among other enhancements. Set for early to mid-March 2025, following extensive testing on Ethereum's test networks, Sepolia and Holesky, scheduled for February 2025. This upgrade will allow Externally Owned Accounts (EOAs) to execute smart contract codes, turning them into smart contract accounts during transactions. This means users can benefit from features like transaction batching, gas fee sponsorship, and more without needing to manage traditional wallets. EIP-7702: Specifically designed to enhance wallet functionality, allowing wallets to act like smart contracts. This could lead to more versatile crypto wallets, where users might pay gas fees in tokens other than ETH, like USDC or DAI, and third-party services could sponsor transaction fees.

Ethereum

👇2-10) Tether has recently announced the launch of USDT0, a significant development aimed at enhancing the interoperability of its USDT stablecoin across different blockchain networks. USDT0 leverages LayerZero's Omnichain Fungible Token (OFT) standard, facilitating secure and seamless asset transfers across multiple blockchains without needing separate liquidity pools or traditional bridging solutions. The system involves locking USDT on the Ethereum mainnet, after which equivalent USDT0 tokens are minted on the target chain, ensuring a secure and transparent process for cross-chain transfers. With the MiCA regulation affecting Tether's operations in the EU, USDT0 is an innovative response to regulatory challenges, focusing on global interoperability.

👇3-10) On January 23, 2025, President Donald Trump signed an executive order titled "Strengthening American Leadership in Digital Financial Technology." This order explicitly bans the creation, issuance, or promotion of Central Bank Digital Currencies (CBDCs) within the United States. The order defines CBDCs as "a form of digital money or monetary value, denominated in the national unit of account that is a direct liability of the central bank." The SEC's withdrawal of the SEC's Staff Accounting Bulletin No. 121 (SAB 121), which had previously created hurdles for banks interested in crypto custody services, has cleared the path for banks to act as custodians for digital assets.

Bitcoin

👇4-10) The SEC announced the formation of this task force on January 21, 2025, shortly after former Chair Gary Gensler resigned. This move represents one of the first significant policy initiatives under the new Trump administration, which has promised a more crypto-friendly regulatory environment. The task force is led by Commissioner Hester Peirce, known within the industry as "Crypto Mom" for her advocacy for more precise, more innovation-friendly regulations for digital assets. Acting Chair Mark Uyeda has also been named, with Richard Gabbert and Taylor Asher serving as chief of staff and policy adviser. Objectives: A) Clarify Regulatory Boundaries: The task force aims to define which digital assets qualify as securities and thus fall under SEC jurisdiction. B) Provide Registration Pathways: They intend to develop practical processes for crypto entities to register with the SEC tailored to the unique characteristics of digital assets. C) Disclosure Frameworks: Crafting sensible disclosure frameworks ensures investors receive necessary information without stifling innovation. D) Enforcement Strategy: Focus enforcement resources more judiciously, moving away from the previous approach of primarily using enforcement actions to regulate.

👇5-10) Uniswap V4 would begin rolling out this week, with all contracts expected to be deployed for a full launch the following week. This signals the start of Uniswap V4's official rollout on the Ethereum mainnet. Allowing developers to attach custom logic to liquidity pools, enhancing flexibility and customization. This could lead to functionalities like on-chain limit orders, custom oracles, fee management, and automated liquidity strategies. V4 is expected to significantly reduce gas costs by up to 99% for pool creation, using a singleton contract architecture and introducing "flash accounting" for more efficient asset transfers during swaps. V4 will support native ETH trading, which means users can swap Ether directly without needing to wrap it first, potentially simplifying the trading process and reducing costs.

Solana

👇6-10) The proposal by Solana to adjust its inflation mechanism for its native token, SOL, has indeed gone live. The aim is to transition from a fixed inflation schedule to one that adjusts based on market dynamics, precisely the staking participation rate. The proposal sets a target staking participation rate of 50%. If more than 50% of SOL is staked, the inflation rate would decrease, reducing new SOL issuance. Conversely, inflation would increase if less than 50% is staked to incentivize more staking. This makes SOL's inflation rate variable, aiming to align issuance with network security needs and market conditions rather than a predetermined schedule.

👇7-10) Avalon Labs has made significant strides in the DeFi sector by releasing Pre-Deposit BeraVaults for sUSDa and USDa, marking a notable development in the landscape of Bitcoin-backed stablecoins. This allows users to deposit USDa (Avalon's Bitcoin-backed stablecoin) into BeraVaults to earn yield through sUSDa, a yield-bearing version of USDa. USDa is unique as it's the first stablecoin to be fully backed by Bitcoin, offering institutional-grade security through partnerships with leading custodians like Cobo, Ceffu, and Coinbase Prime. One of the standout features is the 8% fixed borrow rate for USDa, providing predictable capital costs for borrowers, contrasting with the variable rates ordinary in DeFi lending platforms.

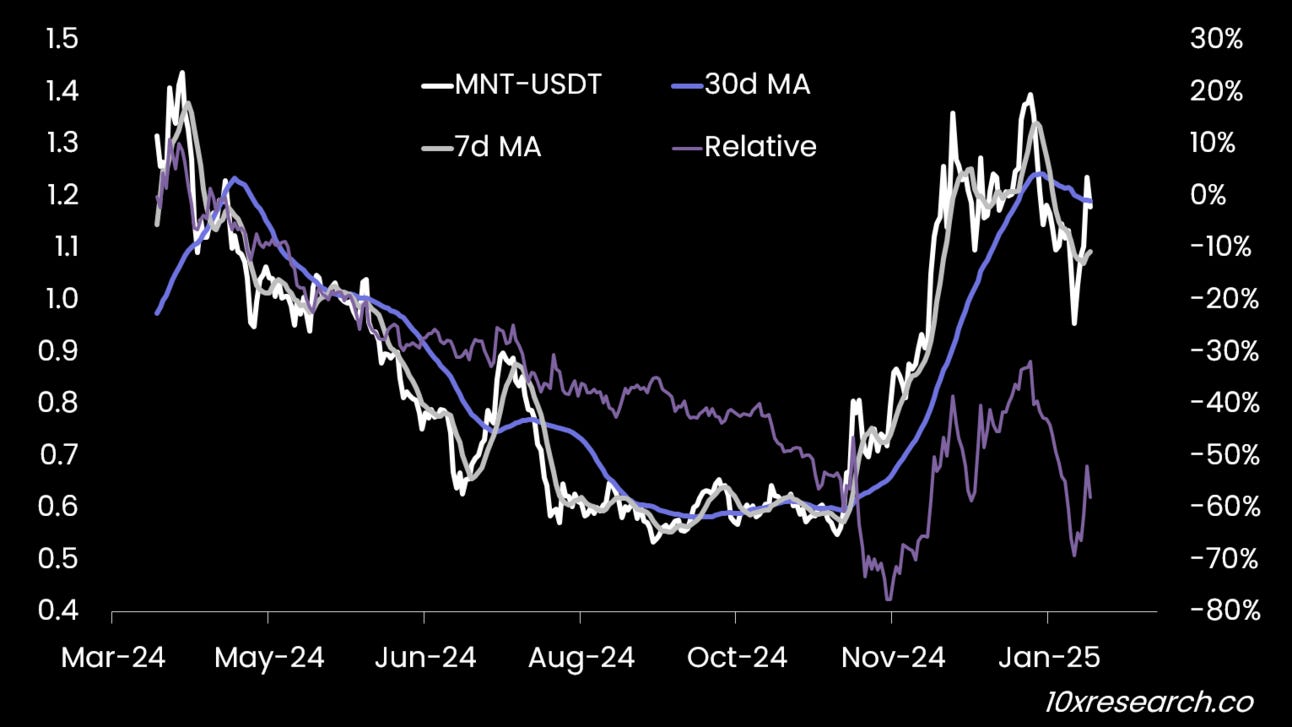

Mantle

👇8-10) Mantle has recently expanded its ecosystem by introducing three new products to enhance its DeFi offerings, alongside the launch of a new feature on the Kaito platform. Mantle Banking is envisioned as a "Revolut-like on-chain app," offering a suite of financial services that operate entirely on the blockchain. This includes payments, lending, and wealth management, all designed with a DeFi-first approach. MantleX is pitched as an AI-augmented company within the Mantle ecosystem, focusing on creating advanced AI agents for various applications, particularly in the crypto and DeFi space. Enhanced Index Fund is designed to bridge crypto and traditional finance (TradFi) by offering access to yield-generating crypto assets through an index fund structure.

👇9-10) Base, a Layer 2 scaling solution built by Coinbase, has announced plans to develop an on-chain account system to simplify user onboarding and enhance interaction with decentralized applications (dApps). Base's new system will allow users to create accounts directly on the blockchain without using traditional wallet setups or managing seed phrases. This aims to remove one of the most significant barriers to entry for new users in the Web3 space.

👇10-10) pSTAKE Finance has significantly expanded the functionality of its Bitcoin liquid staking token, YBTC, by making it an omnichain asset through the integration of LayerZero's Omnichain Fungible Token (OFT) standard. YBTC has been integrated with LayerZero, a protocol known for its cross-chain interoperability solutions. This integration allows YBTC to be transferred between different blockchains seamlessly without the need for traditional bridging mechanisms that involve locking and minting tokens on each chain. Users can now move YBTC across multiple blockchain ecosystems with a single click, enhancing liquidity and usability across DeFi applications on different chains. YBTC, which is already a $35 million+ asset, now has the potential to grow further as its utility expands across multiple chains. This could lead to increased demand and, subsequently, its market value.