The Hidden Downside Risk For Bitcoin, Stocks, Bonds, and Other Assets...

Trump's inauguration is around the corner but...

If you no longer wish to receive our email reports, please click the unsubscribe link below (at the bottom).

👇1-17) It's essential to grasp what's driving the markets and why. While Trump-centric narratives dominate headlines, the financial markets tell a different story. U.S. stocks have erased all their gains since the early November Trump election, which was initially expected to fuel stronger growth and lower taxes. The anticipated post-election rally in altcoins quickly fizzled out on December 6. This date is more than coincidental—it's a pivotal moment with far-reaching implications.

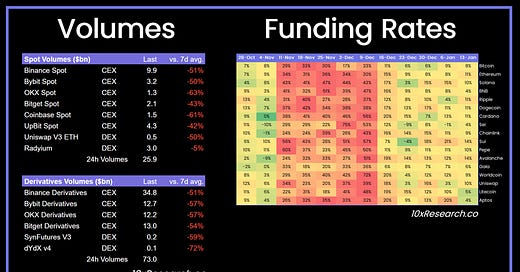

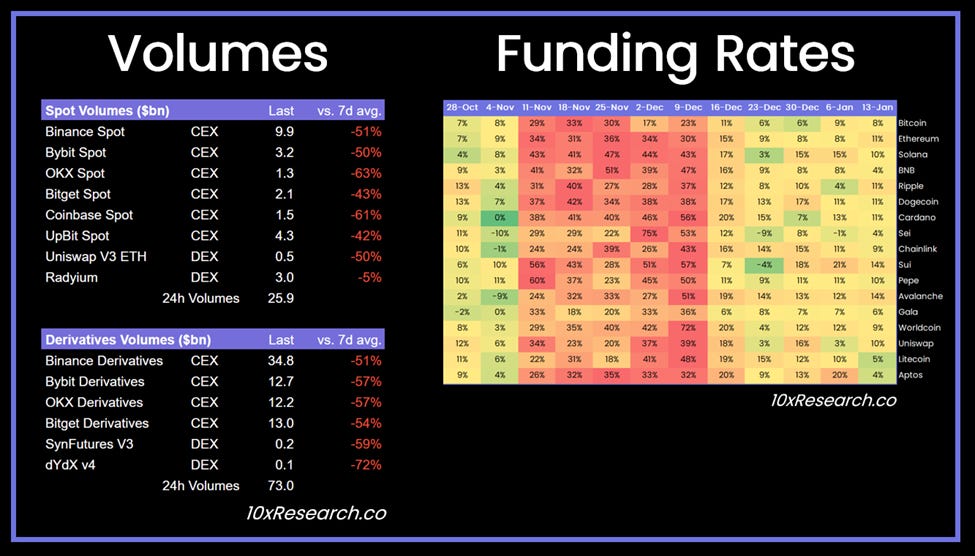

Crypto Trading Volumes (LHS) vs. Crypto Funding Rates (RHS, weekly)

👇2-17) The sharp decline in altcoins after this date is evidence of that. Since the exuberance of early December, crypto trading volumes have dropped substantially, with funding rates peaking on December 6. This suggests a deeper significance to that date. Understanding this could shed light on the current dominant forces driving asset prices.

👇3-17) Macroeconomic factors are the primary drivers of Bitcoin and crypto market cycles. The Fed's decision to implement a 50-basis-point emergency rate cut in September stemmed from fears of an impending recession sparked by the U.S. labor market's apparent weakness.

👇4-17) However, subsequent data painted a different picture. Non-farm payrolls showed only 12,000 jobs added in October but rebounded sharply to 227,000 in November, with the data released on December 6. Last week, the numbers showed another strong gain, with payrolls increasing by 256,000 and the unemployment rate falling to 4.1%, released on January 10. These figures reveal that the Fed’s initial rationale for cutting rates was fundamentally flawed, undermining the argument for their rate-cutting cycle.