🚀 The Hidden Catalysts Behind Bitcoin’s +6% Rally - What's next?

Institutional Crypto Research Written by Experts

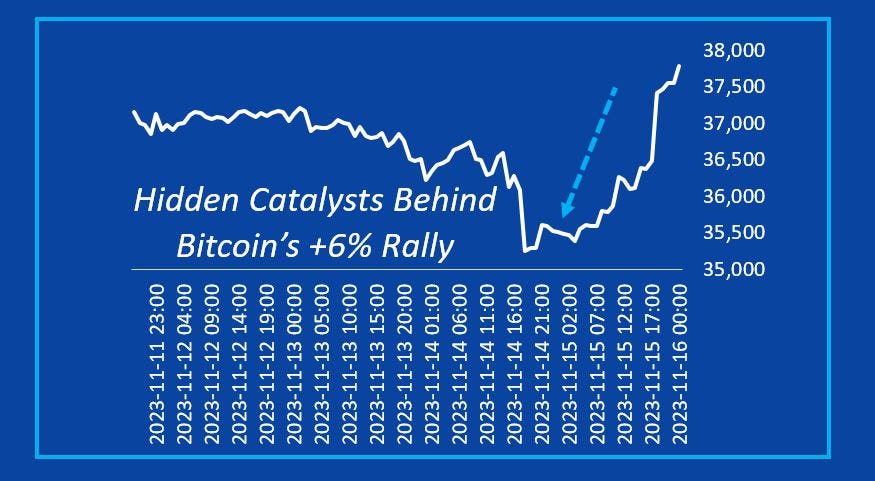

Summary: Bitcoin was very close to seeing the high for the year – potentially even positioning itself for a long sideways correction. The key reason for this volatility was that the US government shutdown was averted, as this would have caused any Bitcoin ETF approval to be delayed at least until January 2024, if not longer. Bitcoin will reach 40,000 – if not even 45,000 - by the year’s end. There are several reasons.

Analysis:

👇 1) Many would not have seen this train crash coming. Still, Bitcoin was very close to seeing the high for the year – potentially even positioning itself for a long sideways correction until February 2024. We have been nearly abandoning our 45,000 year-end target since February 2. We are also the first to call this bull market - based on the analysis of our models, which received confirmation from the price action. On January 13, we wrote ‘Green Shoots - A New Crypto Bull Market?’ Bitcoin traded at 18,800 when we published the note.

👇 2) Readers of our note from yesterday: ‘Bitcoin Sell-Off Averted, Market Breathes a Sigh of Relief’ had expected a continuation of the uptrend after Bitcoin went through a minor sell-off (-4%) during the two days prior. We expected the sell-off and yesterday’s rally. This shows how important it is to stay on top of all the development, as the price swings can be financially rewarding.

But what is next?

👇 3) The key reason for this volatility was that the US government shutdown was averted, as this would have caused any Bitcoin ETF approval to be delayed at least until January 2024, if not longer. When we wrote our note, Bitcoin traded at 35,500, and prices have rallied to 37,800 during the last 24 hours (+6.4%).

👇 4) Bitcoin will reach 40,000 – if not even 45,000 - by the year’s end. There are several reasons. Let’s list some of them:

👇 5) We have two colossal options expiries on November 24 and December 29 with $3.7bn and $5.4bn open interest outstanding. There are 85% more calls outstanding than puts, with the 40,000 strike having the most significant open interest. The closer we get to 40,000, the more people will have to buy Bitcoin to hedge themselves. There will be a broad interest in pushing prices to this 40,000 level. The odds are high that we reach this level.

👇 6) While there have been $1bn inflows into crypto investment products during the last two months, Tether is the more significant driver of this bull rally and minted nearly $4bn of USDT stablecoins. This shows that large market players are converting fiat into crypto, which is a crucial reason why Bitcoin – and altcoins are seeing strong interest. FOMO is back - Traders Panicking - as we wrote on October 20.

👇 7) When we wrote our note about a Santa Claus rally on November 2, US tech stocks (Nasdaq) had corrected by -9%, but since our report, those shares are up +8% and appear to make a new year-to-date high soon. This is a positive feedback loop ‘Bitcoin is ready to Soar’ from other risk assets that benefit crypto.

👇 8) The trigger for this rally from early November was also a dovish Fed Chair press conference, which opened the door to a two-way (higher or lower) thought process in terms of inflation by the Fed members. The Fed was no longer only expecting upside inflation.

👇 9) Weaker economic data, notably on the cyclical manufacturing and the employment side, would no longer force the hand of the Fed and hike rates. Another important catalyst was that the US inflation data appears to have re-started its downtrend after three to four months of gradually rebounding. Based on our inflation model, this trend will continue, and inflation will see sub-2.0% in 2024.

👇 10) This will cause the Fed to cut interest rates aggressively. To remind you, US inflation is currently at 3.2% while interest rates are at 5.25% - a difference of 2.0%. If our inflation model is current, then this spread would even be 3.0% - so we could expect 200 basis points of rate cuts next year. This is bullish!

👇 11) The interest rate-sensitive money market funds are holding $5.9 trillion, with around $1 trillion added from when the Fed started hiking interest rates. This is a lot of firepower that will likely find a higher-yielding home next year. As another reminder, Bitcoin is up +127%, and the Nasdaq is up +35% - significantly outpacing any ‘risk-free’ deposit that investors receive in money market funds yielding 5.19%. Do you know anybody who wishes they had put more money in money market funds earning 5% in 2024? I certainly don’t.

You might also like: Bitcoin on the Verge of an Explosive Breakout?

You might also like: Will The Fed pause cause a +300% Bitcoin Rally?

SHARE WITH A FRIEND

Thanks for reading. If you liked today's brief, we'd love for you to share it with a friend.

Partner with us

DeFi Research is much more than just this newsletter: we’re a full-blown one-stop shop for engaging with modern investors. Mail us for partnership deals: info@defiresearch.com

WANT TO SPONSOR THIS NEWSLETTER?

Over 10,000 subscribers are throwing a party, and your brand is invited!

Tap into our network of savvy (and good-looking) crypto & Web3 enthusiasts eager to learn and invest.

All content provided by DeFi Research is for informational and educational purposes only and is not meant to represent trade or investment recommendations.