The 7 MicroStrategy (and Bitcoin) catalysts traders are watching for the next 8 weeks

MicroStrategy's options volume indicates a bullish shift into late October/early November.

👇1-13) Bitcoin and crypto markets often thrive on momentum, where success lies in backing the winners, doubling down on them, and cutting underperformers quickly. While we made strong bullish calls on several Bitcoin miners last year, identifying similarly attractive entry points this time has been more difficult. The opportunities haven’t aligned, and the anticipated divergence—where miners' rising revenues outpace their stock prices—has yet to occur.

👇2-13) On September 24, just days after the FOMC meeting where Fed Chair Powell announced the widely anticipated rate cut, we observed a potential shift in Bitcoin's dominance, signaling a peak, as several altcoins began to outperform. In our September 24 report, we highlighted several of these altcoins, and those who acted on our insights would have seen strong returns. TAO (+17%), ENA (+12%), SEI (+6%), APT (+22%), and SUI (+28%) all extended their rallies, while NEAR (-14%) and GRT (-13%) underperformed. Five out of the seven tokens delivered positive returns – overall, momentum continued for those winners.

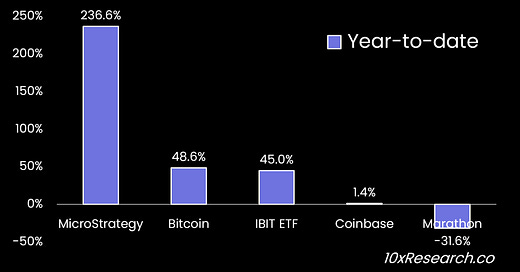

Year-to-date performance

👇3-13) Momentum has continued for MicroStrategy, following the potential breakout we identified a week ago. The stock has surged 16% in the past week, reaching new all-time highs with a market capitalization of $43 billion. This upward trend could persist, with several critical catalysts on the horizon. As mentioned, this may create a 'tail wags the dog' scenario, where MicroStrategy's stock performance could positively influence Bitcoin’s price.