Taking Profit on Bitcoin Miners: Bitfarms +25% in just two weeks

Institutional Crypto Research Written by Experts

Does your crypto card offer no rewards? KAST’s early adopter program gives 3-9% rewards on spending. 10X subscribers though, get up to a 3X multiplier taking rewards to 27%!

EXCLUSIVE OFFER: Join the waitlist & use campaign code “10X”

https://kast.finance/

When we see the code, we’ll fast-track you to onboarding. Be quick—the early adopter program has limited spots, and phase 1 entry closes June 21st.

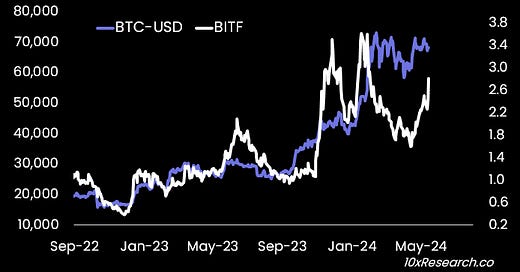

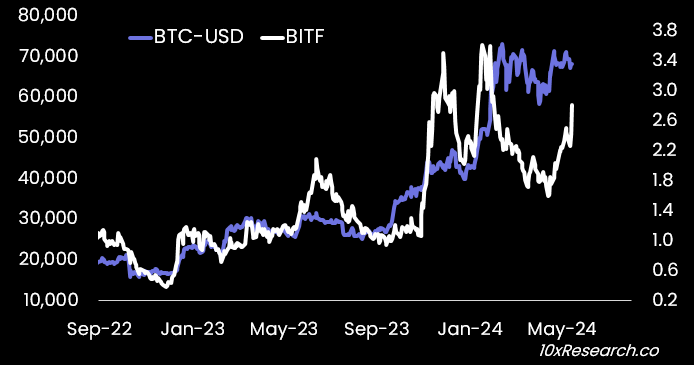

👇1-12) In our strategy report, ‘Bitcoin Mining Wars Are Heating Up—How to Play it?', we identified Bitfarms as the prime beneficiary of the ongoing consolidation within the Bitcoin mining industry. Since our report’s publication date, Bitfarms shares have surged by +25%. Other favorites, like Bitdeer (+61%), have also seen significant gains—all within two weeks.

👇2-12) We suggest caution. Bitcoin saw a slight decline of -1% during those two weeks and failed to break above the 71,946 resistance level. Although mining stocks, crucial takeover targets like Bitfarms, could rally further, we prefer exposure when there is a bullish underlying trend in Bitcoin. This is not currently the case, with the self-reinforcing Bitcoin mechanism generating less liquidity in February / March (see our webinar).

👇3-12) Despite MicroStrategy announcing another potential $500m bond offering to buy more Bitcoins, the market reaction is relatively muted – contrary to Q4 2023 and Q1 2024, when those announcements caused a euphoric rise in retail speculation, a rising funding rate, and so on.