Solana Surpasses Ethereum in Daily Fees – What Are the Smart Trades?

Bitcoin successfully retests the $66,500 level - the environment is still constructive.

👇1-12) A series of overly academic articles from Ethereum founder Vitalik Buterin, combined with declining revenues, has contributed to Ether's price correction amid resurfacing macroeconomic challenges. Key shifts are taking place across various blockchains, highlighted by changes in fee generation. If these trends continue, they could reveal intriguing trading opportunities for those closely analyzing the evolving landscape.

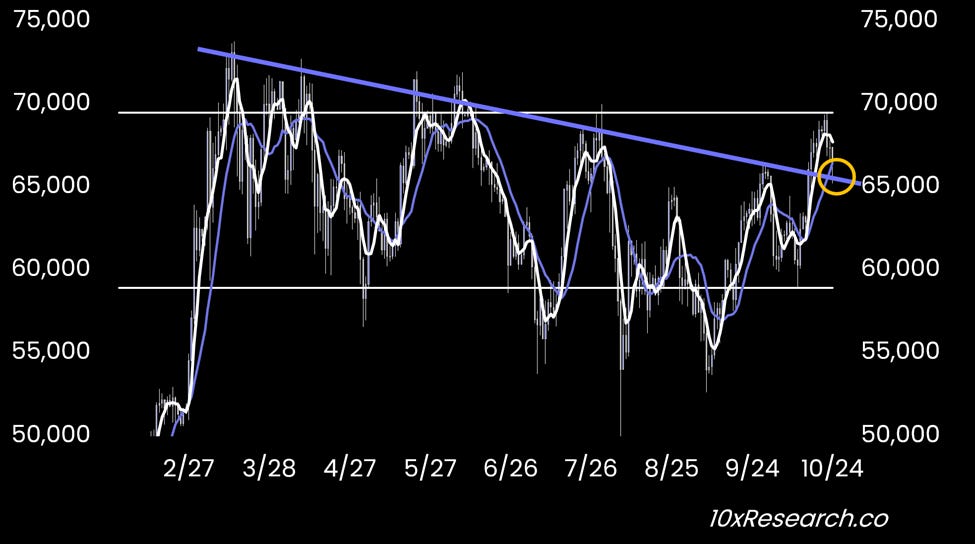

👇2-12) Bitcoin has retraced to the level where prices initially broke above the downtrend line that has been in place since early March. This line has been tested six times, and based on the technical indicators at the time, it seemed reasonable to expect a sustainable breakout. Despite the significant resistance around the $69,000/$70,000 range, which has capped rallies six times and most recently rejected Bitcoin a seventh time, the overall setup remains encouraging.

Bitcoin is retesting the breakout level ($66,500)

👇3-12) Weekly reversal indicators have rebounded after reaching levels where the uptrend could reestablish itself, leading us to adopt a more constructive view of Bitcoin despite the ongoing correction. What's different this time compared to previous failures at those resistance levels is that weekly technical indicators have corrected sufficiently—unlike the conditions seen in July or August.