Smart Traders Are Switching Out of Bitcoin and into....

A new SEC Chair, a DeFi ruling, and derivatives markets indicate that...

Bitget offers exclusive benefits for 10x Research members, including reduced trading fees and a BTC/USDT trading position voucher. Given these perks, we believe highlighting this opportunity for our community is worth highlighting.

Sign up here

👇1-13) A U.S. appeals court has deemed the Treasury Department’s sanctions against the crypto mixer Tornado Cash unlawful, citing overreach of authority. In 2022, the Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash—an Ethereum-based tool enabling users to anonymize crypto transactions—alleging it facilitated North Korean agents laundering stolen funds. Since then, its developers have faced extensive legal battles and the threat of imprisonment.

👇2-13) However, the U.S. Court of Appeals for the Fifth Circuit, led by Judge Don Willett, ruled that OFAC misinterpreted the definition of “property” in its statute. The court stated that Tornado Cash, as an entity, does not own the immutable smart contracts it employs, nor do these contracts independently constitute property apart from their functionality.

👇3-13) While the ruling does not endorse money laundering, it establishes a precedent allowing programmers to develop and release smart contract protocols without fear of sanction, provided they do not charge fees. As Ethereum remains the leading blockchain for DeFi, this decision is viewed positively for the broader DeFi ecosystem and other protocols, particularly on the Ethereum network. This could have enormous implications.

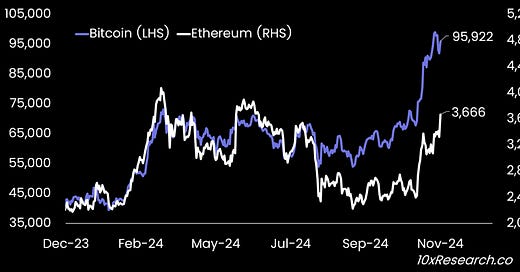

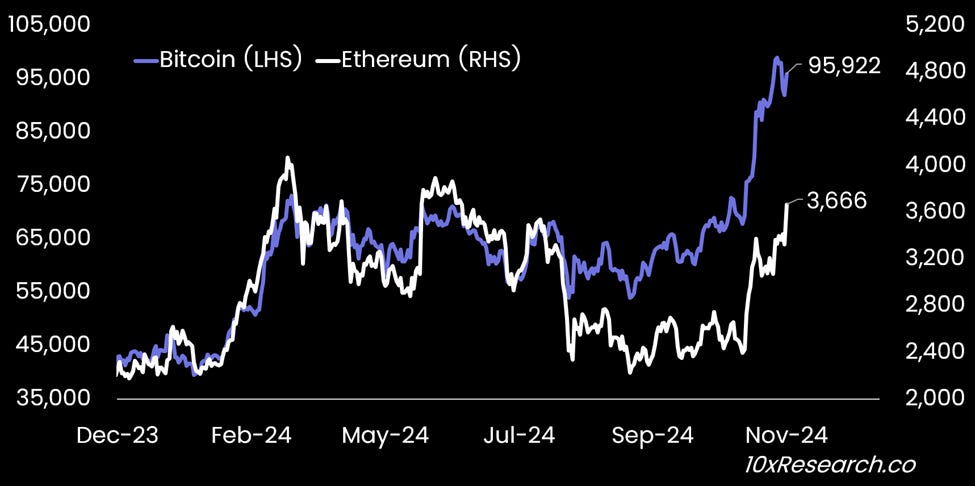

Bitcoin (LHS) vs. Ethereum (RHS)