"Regulating Crypto is a never-ending game" - Singapore's new president 💥💥💥

Helping EVERYONE to make better crypto investment decisions.

👇 1) Singapore has elected a new president who previously was the Chairman of the Monetary Authority of Singapore (MAS) when the MAS handed out the first crypto exchange licenses. While many are hopeful that Singapore will build out its crypto leadership, his comment is worth re-watching.

👇 2) Bitcoin price is 25,951 below the 50d MA 28,299 -> this is bearish, price WoW decreased by -1%; Ethereum price is 1,635 below the 50d MA 1,789 -> this is bearish, price WoW decreased by -1%; overall the trend is down -> bearish.

👇 3) Ethereum currently underperforms Bitcoin as the trend (20d) MA shows ETH / BTC ratio is going down, beta factors drive Crypto, this is negative in the absence of a bull market, so stay cautious.

👇 4) During the last month, USDT has lost $1bn in market cap and has consistently traded (marginally) below the 1:1 peg. The decline in market cap was first associated with a move into Bitcoin on August 8 when $400m was moved from USDT into BTC. But then another $500m appeared to have been redeemed when Bitcoin prices crashed around August 18. Liquidity leaving the ecosystem, is always negative.

👇 5) TVL has dropped to the lowest since February 2021, at only $37.7bn. While Lido saw a small increase in its TVL of +0.3% to $14.1bn during the last week, MakerDao lost -1.7%, Aave -0.5%, JustLend -0.8%, Uniswap -1.9% & Curve Finance -3%.

👇 6) Vitalik Buterin has offloaded his remaining stake in MakerDao tokens after the project's co-founder praised the Solana blockchain. The CEO of MakerDao, Christensen expressed interest in forking from the Solana blockchain, a Rust-based codebase, and shifting away from the current Solidity-based Ethereum platform.

👇 7) The futures funding rate trades positive for Bitcoin (4.9%), this is bullish & the funding rate is positive for Ethereum (3.2%). Futures traders still appear to expect a rally. Overall the funding rate is trading ‘fair’ across the board with the biggest exception being Axie Infinity which is trading at an annualized discount of -66% and will go through another massive unlock in October of 11% of tokens which will pressure prices.

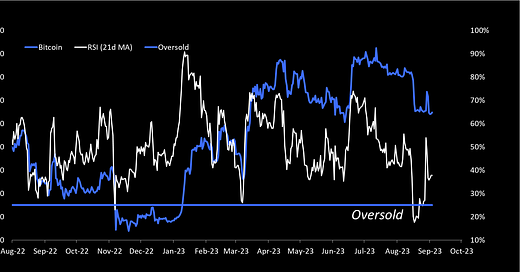

👇 8) Our Greed & Fear Index prints 21%, while the Ethereum Greed & Fear Index prints 13%. The RSI for Bitcoin is 38% while the Ethereum RSI is 37%. A small technical divergence is occurring that could be interpreted as bullish. The moving average of our Greed & Fear index should be turning up soon.

👇 9) Realized volatility has increased to 42% for Bitcoin and 37% for Ethereum. Historically, Ethereum’s volatility has only temporarily traded below that of Bitcoin.

👇 10) Trading volume in USDT has averaged $22bn during the last week, compared to Bitcoin's $15bn, Ethereum's $5bn, with derivatives volume on Binance averaging $28bn per day, & spot volume on Binance averaging $6bn per day.