Quant Analysis for Crypto Traders 💥

Helping EVERYONE to make better crypto investment decisions.

While there are different ways to make money in crypto, we prefer a low latency quant approach where we combine our judgment of working for the world’s most successful hedge funds and proprietary trading desk with solid quant analysis. Low latency means that we can work with a time delay and do not rely on high-frequency tools per se, which tends to be a technology arms race. A few examples:

🚩 A few bullet points:

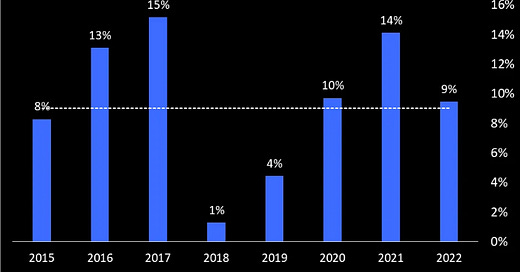

👇 1) On January 20, we predicted that the upcoming Chinese New Year would bullish for Bitcoin. “Buying Bitcoin at the end of the first day of Chinese New Year and selling it 10 trading days later would have returned +9%, on average, with all of the last eight years (2015-2022) showing positive returns. This is a hit ratio of 100% (8 wins, 0 losses). If history is any guide, then investors could buy Bitcoin this coming Sunday January 22, 2023 and sell it 10 trading days later on Wednesday February 1, 2023 for +9% higher.”

The Tweet with our analysis has been seen by 240k followers and within 24 hours, Bitcoin was indeed up by +10%…..

👇 2) On February 1, we sent out the ‘January Effect’ analysis which predicts that Bitcoin could rally to 45k by December 2023. At the time, Bitcoin was trading at 22k. The Tweet with our analysis has been seen by 240k followers and within 24 hours, Bitcoin was indeed up by +10%…..”When Bitcoin prices are up in January, as has happened six times, then the return for the remaining year (Feb – Dec) has averaged +245% with five out of those six years (83%) showing positive returns.”

👇 3) Our analysis from January 5 indicated that Ethereum prices could rally by +27% into the March Shanghai upgrade. That report was based on some numbers we ran and indeed Ethereum quickly achieved the 1,600 price target.

👇 4) On March 8, we warned about a breakdown in the Bitcoin rally. “When Binance halted USD transfers in January, Bitcoin prices dropped -10%. Obviously, Binance has a much bigger impact than other exchanges but also now ByBit will halt USD transfers from March 10 onwards.”

👇 5) On March 11, we turned around and suggested “probably worth to buy Bitcoin here… the Fed might now only hike 25bps due to Financial Stability concerns and next week is the CPI window” …. that was when Bitcoin traded at 20,290…

👇 6) On March 27, we wrote that Bitcoin could hit 30k very soon. “As the quarter end is approaching this week, fund managers likely want to show that they own the ‘right’ stocks when they sent out their statements next month. That’s why they have to buy tech stocks this week. Bitcoin could break 30,000 this week.”

👇 7) While Bitcoin did not make it to 30k that week, we sent out another alert….. on April 10: “Bitcoin is now trading at the ‘buy cycle bottom,’ which we identified at the end of last year. This signal has worked three times (see chart) and appears to set up Bitcoin for the next leg higher.”

Of course we had tons of other great calls and right now, we are killing it… so share this with your friends and colleagues, lets grow this distribution list….

Questions? Send us a message….