🚀 Panic – Bitcoin Goes Parabolic – What You MUST Consider NOW

Institutional Crypto Research Written by Experts

👇1-10) Bitcoin’s funding rate exploded from 25% to 75% (annualized), even eclipsing the 66% reached the week ahead of the ETF approvals. Similarly, the funding rate for Ethereum peaked at 50% in January but climbed to 60% last night. Futures open interest increased by another $500m for Bitcoin to $15bn while Ethereum’s open interest declined marginally by $-200m.

👇2-10) Coinbase’s three-hour outage spooked the market, and in crypto, an exchange outage is often the result of malpractice. In this case, it does not appear this way; instead, massive demand caused the system to overload. Bitcoin even took out our 63,000 target, which we had projected in October 2022 to occur in March 2024.

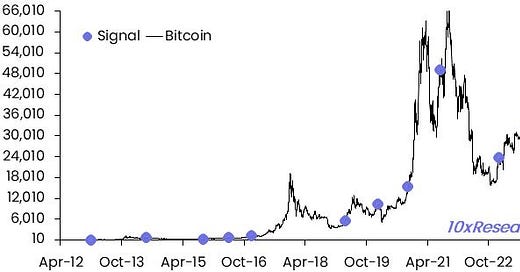

This signal was just triggered; what it means for Bitcoin.

A few data points reveal how massive the day was: