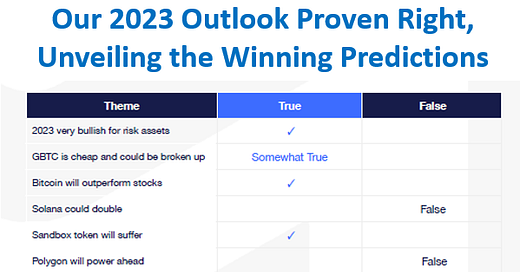

Our 2023 Outlook Proven Right, Unveiling the Winning Predictions 💥

Helping EVERYONE to make better crypto investment decisions.

👇 1) On December 2, 2022 we published a report, 'With a macro tailwind, Bitcoin might be at 29k in 2023'. Crypto revenues and transaction volumes were rebounding and we were very bullish on the macro outlook and expected lower inflation to drive Bitcoin prices higher.

👇 2) On December 9, 2022, we published ‘Outlook 2023: 18 Crypto Events to Look Forward to’ when Bitcoin was trading at 17,133, while most market commentators expected prices to drop even further to 15,000, we were bullish and remained relatively bullish since.

👇 3) We also published our mid-cycle halving report (Bitcoin might rally to $63,160 by March 2024) on October 28, 2022, which suggested that Bitcoin prices could bottom during the next 1-90 days, as prices had done during the two previous halving cycles. If history is any guide, Bitcoin might rally to $63,160 by March 2024 (+207%) when the next halving event is expected.” Bitcoin prices were trading at $20,400 when the report was published.

👇 4) Our bullish stance for 2023 was (and continues to be) based on our macroeconomic model, which projected that inflation would fall from 7.7% to 2.0%.

👇 5) We highlighted that the Grayscale Bitcoin Trust (GBTC) was trading

at a significant -47% discount to its net asset value (NAV). We identified a potential $5bn in value that could be unlocked if a large investor attempted to break up this Trust. Since December 9, 2022, GBTC has rallied by +142%, outperforming Bitcoin’s +78% rally.

👇 6) On January 6 2023 we published 'Ethereum's Shanghai Upgrade might bring +27% upside'. ETH only traded at 1,266 back then and rallied by +32% into the Merge.

👇 7) Our report from February 1 2023 'January Effect - Bitcoin to $45k by December' pointed out that the probability of Bitcoin rallying into year-end when January is positive was 83%. Prices were at 22,500 and the last two times January was up BTC rallied by +100% -> hence our 45,000 price target.

👇 8) Bitcoin tends to move 10,000 points up, only to retrace 5,000 and then rally another 10,000 points (until we reach 45,000 by year-end). We have seen a rally from nearly 15,000 to 25,000 only to drop back to 20,000 due to the U.S. banking crisis, then rally another 10,000 points to 30,000 and sell off to 25,000 because of the Binance-SEC lawsuit. Now we appear on the way to 35,000 as the expectations for the Bitcoin ETFs approval will bring more U.S. institutions and U.S. retail into this space

👇 9) July tends to be a strong month for Bitcoin when prices have finished positive in 7 out of the last 10 years, with average returns of +11%. The 2020, 2021, and 2022 returns were +24%, +20%, and +27%, respectively. Therefore, the probability that Bitcoin will be +10-20% higher during the next 30 days is high. Hence, Bitcoin could be at 33,000 to 36,000 by August.

👇 10) Good luck trading.