One of Our Top Altcoin Picks Soars +25% in 2025 – Are You In?

Bitget offers exclusive benefits for 10x Research members, including reduced trading fees and a BTC/USDT trading position voucher. Given these perks, we believe highlighting this opportunity for our community is worth highlighting.

Sign up here

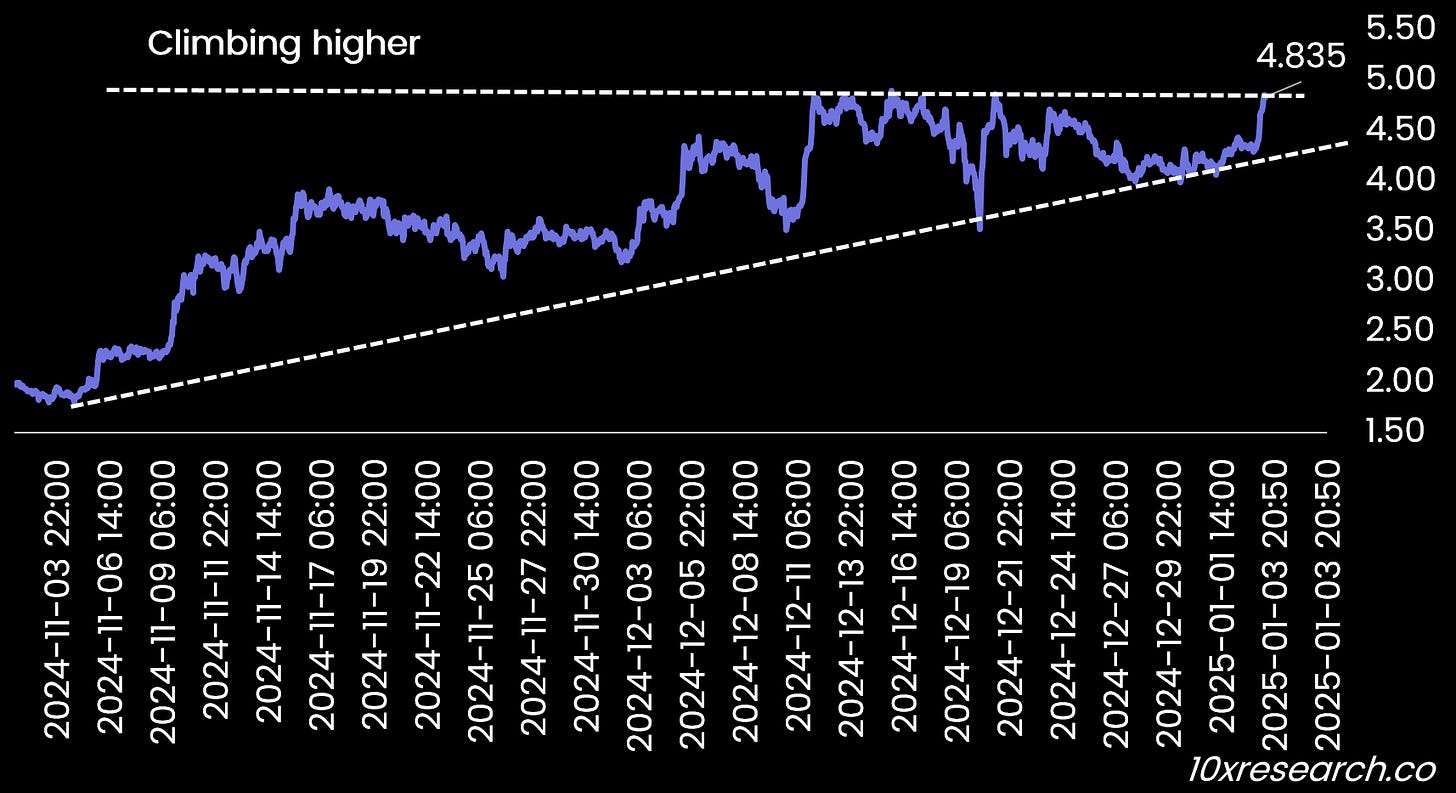

👇1-15) The SUI-USDT token has surged +180% since our March 2024 Strategy Report recommendation. With a market capitalization now at $15 billion, it may be time to explore other opportunities. Similarly, JITO-USDT, which has gained +85% since we highlighted it on November 5, demonstrates our strategy of aligning with larger protocols for added security.

👇2-15) We're excited to introduce a new idea as we continue to uncover promising altcoin opportunities for 2025. While still speculative and currently listed primarily on Bybit (available here) as its major exchange, we anticipate additional listings soon, which could drive momentum as the token’s market cap expands. Let’s dive into our investment thesis.

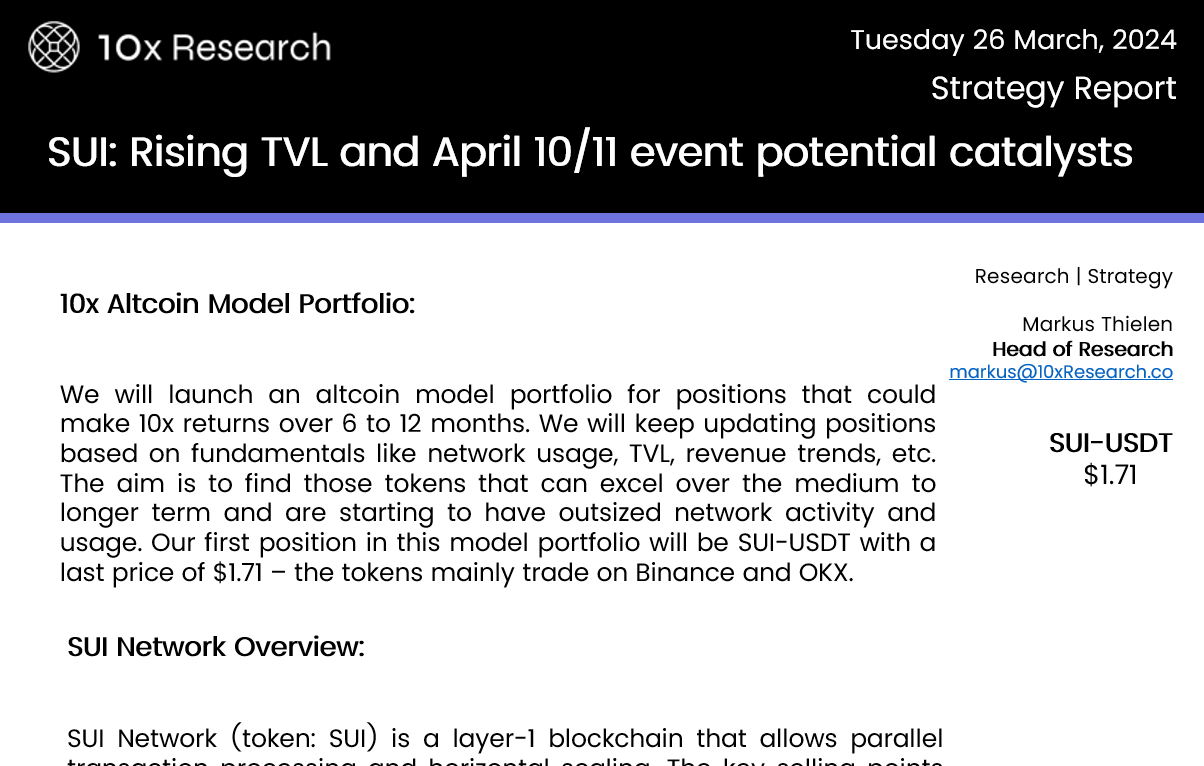

DEEP-USDT - hourly data

👇3-15) For Jito, this was Solana, while for Deep, it is the Sui network, which has grown significantly with its large market cap. Although we remain optimistic about SUI, we now favor higher beta opportunities. Like ZEUS-USDT, the DEEP-USDT token is currently available on smaller exchanges and is still awaiting listings on larger platforms despite a market cap of $280 million.

Investment Case for $DEEP (DeepBook on Sui)

👇4-15) Overview: $DEEP represents the native token of DeepBook, a sophisticated liquidity layer on the Sui blockchain. It combines the features of a Central Limit Order Book (CLOB) with decentralized finance (DeFi) capabilities, providing a scalable, versatile trading infrastructure. Here’s a structured investment case for $DEEP:

👇5-15) Market Position and Utility: Liquidity Backbone: DeepBook is pivotal in the Sui ecosystem, serving as the liquidity layer for numerous DeFi applications. Its integration with key DeFi protocols like Cetus, Aftermath Finance, and Suilend suggests a strong foundation in the ecosystem, potentially increasing the utility and demand for $DEEP as a governance and utility token.

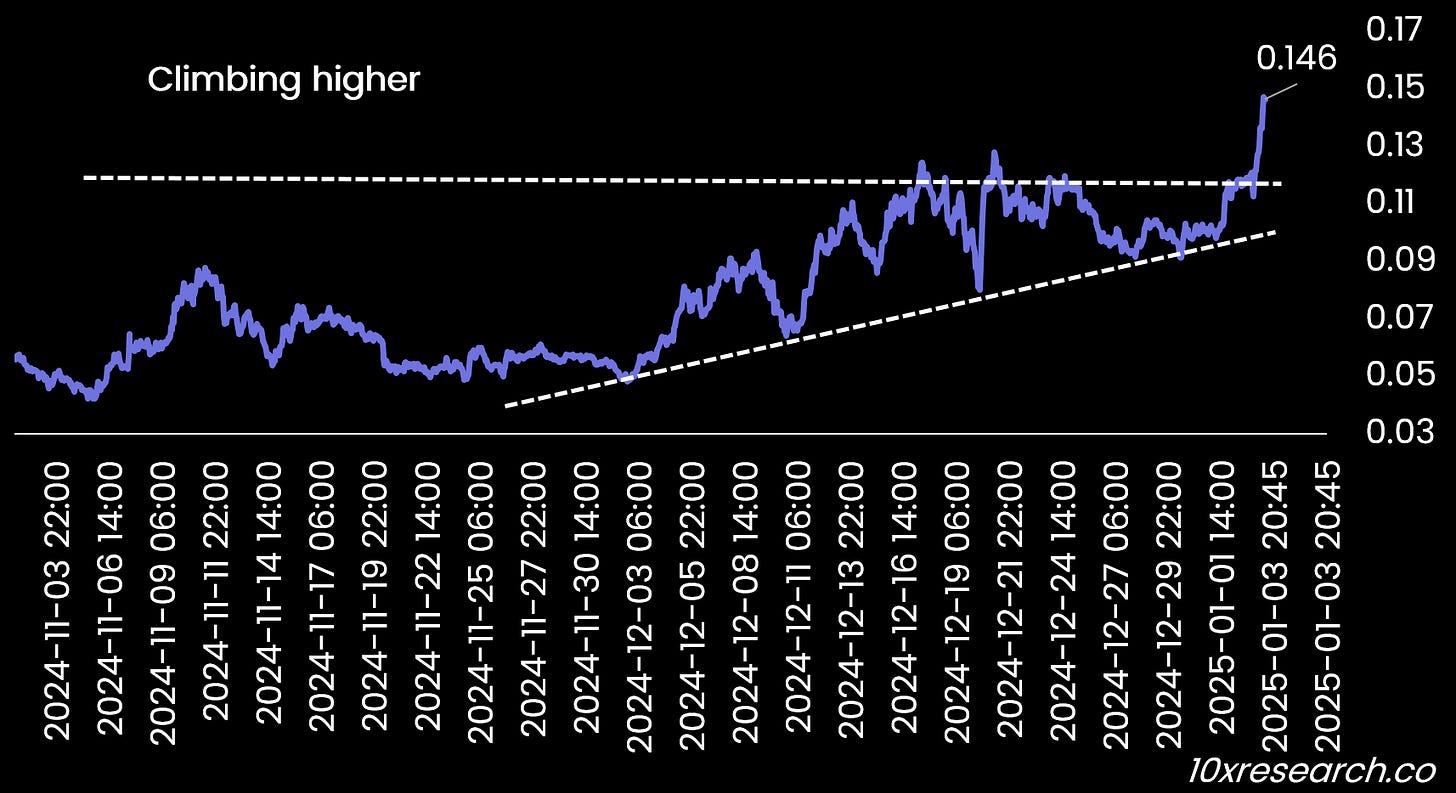

SUI-USDT - hourly data - climbing higher, should benefit DEEP-USDT

👇6-15) Scalability with Sui: As the Sui blockchain grows, so does the need for efficient liquidity solutions. DeepBook's architecture benefits directly from Sui's increasing transaction volumes, making $DEEP a compelling investment as Sui scales.

👇7-15) Technological Advantages: Innovative Trading Mechanism: DeepBook offers a unique blend of traditional order book features with DeFi flexibility. It allows for native asset trading across different blockchains without the need for bridging or wrapping, which is a significant advancement in DeFi trading.

👇8-15) Deflationary Model: $DEEP operates under a deflationary model where tokens are removed from circulation through various mechanisms like transaction fees, potentially increasing the value of remaining tokens over time. This has led to significant token burn since its token generation event (TGE).

👇9-15) Community and Developer Support: There appears to be strong community support for $DEEP, as seen from active discussions and endorsements on platforms like X, where users view it as a fundamental part of Sui's infrastructure with potential for significant growth, akin to Serum’s role in the Solana ecosystem.

👇10-15) Low Market Cap: Currently, $DEEP has a relatively low market cap ($288m with $26m daily trading volume), suggesting room for substantial growth, especially as more projects integrate with DeepBook. This positions $DEEP as an attractive "beta play" on the rising fortunes of the Sui ecosystem.

👇11-15) Market Volatility: As with any cryptocurrency, $DEEP is subject to the high volatility of the crypto market. Investors need to be prepared for price swings.

👇12-15) Competition: While DeepBook has a unique position, new entrants in the liquidity layer space could challenge its dominance if it offers more innovative solutions or better integration with emerging platforms.

👇13-15) Regulatory Risks: Changes in regulations related to DeFi or cryptocurrencies could impact the operation and valuation of $DEEP.

👇14-15) Revenue Mechanisms: $DEEP benefits from trading fees, staking rewards, and possibly other revenue streams tied to the growth of the Sui ecosystem.

👇15-15) Growth Trajectory: Sui's transaction volumes are expected to increase, and DeepBook's role as the primary liquidity provider means that if Sui captures a significant market share in DeFi, there's potential for $DEEP to see exponential growth.

SUI-USDT trading volume (LHS) and SUI-USDT (RHS) - strong momentum

As mentioned, the DEEP-USDT pair is limited to a few cryptocurrency exchanges, with Bybit being the largest. However, we anticipate that additional exchange listings could follow, likely boosting trading volumes and potentially driving higher prices.