Money Supply Is Crashing! Should Bitcoin Traders Be Fearful?

Things are not always as they appear...

Bitget offers exclusive benefits for 10x Research members, including reduced trading fees and a BTC/USDT trading position voucher. Given these perks, we believe highlighting this opportunity for our community is worth highlighting.

Sign up here

👇1-11) Over 90% of my professional career has been managing money for major institutions like JP Morgan and leading hedge funds such as Millennium. I’ve also founded and managed my hedge fund and served as the CIO for a crypto hedge fund. These experiences taught me that no single data point can be the basis for sound investment decisions.

👇2-11) The market is a dynamic sentiment-driven machine, where narratives often diverge from fundamentals. The real skill lies in identifying when the market shifts its focus to these changing narratives, typically tied to shifts in sentiment and positioning. We prioritize market structure analysis alongside daily evaluations of fundamentals, on-chain metrics, macro data, and more. Making accurate market calls requires constantly understanding what matters most—and when it matters.

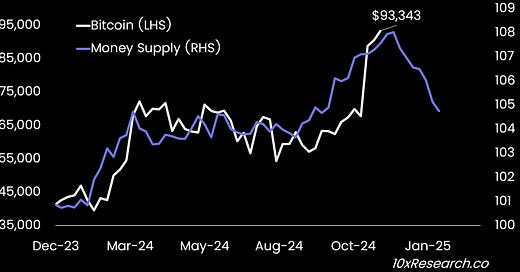

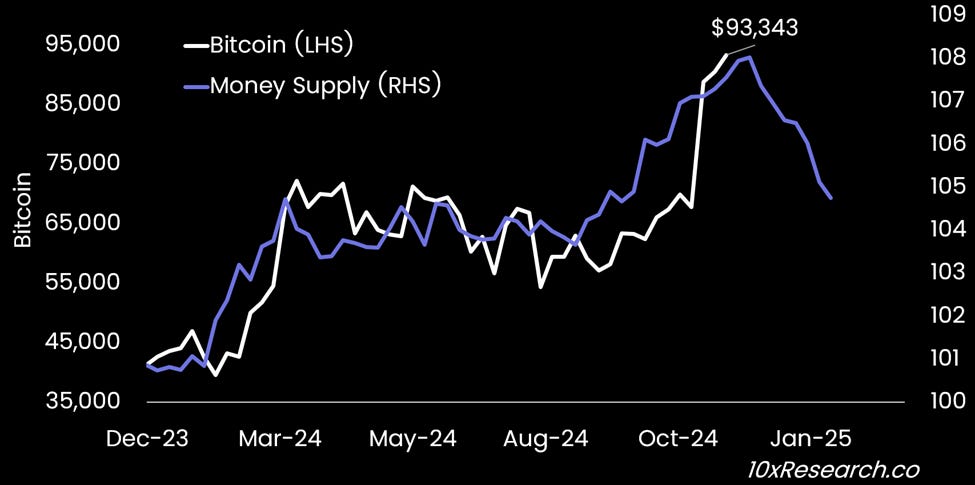

Bitcoin (LHS) follows Global Money Supply (RHS) with a 10-week lag.

👇3-11) A frequently discussed macroeconomic indicator is the rise in global money supply, which has grown by more than $50 trillion over the past decade. This surge has seemingly benefited Bitcoin holders, as the "money printer" effect has fueled its appeal as a hedge. The global money supply recently experienced another sharp increase, historically leading Bitcoin's price movements by about ten weeks. However, it has since reversed course, dropping significantly.

👇4-11) As a result, traders bullish on Bitcoin during the summer based on rising money supply data might now consider shifting to a bearish stance (???). That said, the relationship is more nuanced than it appears, and we’ve provided a deeper analysis with answers below.