🚀Lido TVL Skyrockets fueled by Ethereum Staking Surge

Institutional Crypto Research Written by Experts

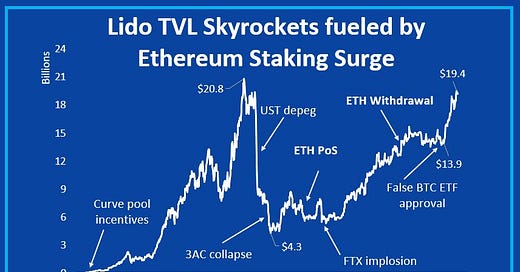

Black Friday SALE - only until November 30

Summary: Total Locked Value (TVL) has increased during the last 4-6 weeks, with ‘Liquid Staking’ driving the use cases. A false tweet from a crypto news website on October 16 claimed that the SEC had approved BlackRock’s Bitcoin spot ETF. Since October 20, Lido’s TVL has increased from $13.9bn to $19.4bn (+39.5%) in just one month. While TVL increased by +228% for Lido this year, the LDO-USD token has only increased by +80% - underperforming Bitcoin, which is up +125%.

Analysis:

👇 1) This crypto bull market is broadening beyond ‘Bitcoin being a new pillar in TradeFi investment portfolios’. The downtrend in Bitcoin’s dominance reveals that DeFi is making a comeback (see our notes from the last two weeks) – despite being an underperformer for most of 2023.

👇 2) Total Locked Value (TVL) has increased during the last 4-6 weeks, with ‘Liquid Staking’ driving the use cases.

👇 3) A false tweet from a crypto news website on October 16 claimed that the SEC had approved BlackRock’s Bitcoin spot ETF. Subsequent news items reminded investors that a US-listed Bitcoin ETF was likely and potentially imminent.

👇 4) The Deposit Corporation listed BlackRock’s Bitcoin ETF; a judge ordered the SEC to re-review Grayscale’s ETF bid. This altered the crypto market, with Bitcoin rallying at a rate of +40%.

👇 5) Since October 20, Lido’s TVL has increased from $13.9bn to $19.4bn (+39.5%) in just one month. The fragmentation of the DeFi market has favored liquid staking protocols this year, as we expected and wrote in our January 6, 2023 report.

👇 6) Back then, only 14% of ETH was stacked vs. 23.2% today, and while Lido had a TVL of $6.14bn, today's TVL is back to the 2022 high of $20bn. Our analysis showed that the average Layer 1 staking ratio was 58%.

👇 7) While the LDO-USD token rallied above $3.0 and finished monthly at $2.7, the price dropped back to $1.7 despite revenues becoming ‘predictably’ stable with a potential upward trajectory if the trend in staking continues – as we expect with 22% of Ethereum being staked vs. 58% of Layer 1 (based on our January 2023 analysis.

👇 8) This stable revenue could set a floor under the LDO-USD token at $1.7, with the upside being the all-time high with TVL reclaiming this level.

👇 9) While TVL increased by +228% for Lido this year, the LDO-USD token has only increased by +80% - underperforming Bitcoin, which is up +125%.

👇 10) LDO-USD is breaking out of a large triangle formation, and with the amount of ETH being staked continuing to increase, Lido itself should continue to be a key beneficiary of the trend in staking.

🤫Binance / CZ guilty – what it means for the Crypto industry

SHARE WITH A FRIEND

Thanks for reading. If you liked today's brief, we'd love for you to share it with a friend.

Partner with us

DeFi Research is much more than just this newsletter: we’re a full-blown one-stop shop for engaging with modern investors. Mail us for partnership deals: info@defiresearch.com

WANT TO SPONSOR THIS NEWSLETTER?

Over 10,000 subscribers are throwing a party, and your brand is invited!

Tap into our network of savvy (and good-looking) crypto & Web3 enthusiasts eager to learn and invest.

All content provided by DeFi Research is for informational and educational purposes only and is not meant to represent trade or investment recommendations.