Key Considerations for Profitable Bitcoin Traders Right Now

Institutional Crypto Research Written by Experts

👇1-14) Many attribute the Bitcoin sell-off to the unwinding of the Japanese carry trade, but the reality is more complex. Bitcoin has been vulnerable since mid-March, and despite a 15% rally in the Nasdaq and a 10% weakening of the Japanese Yen during this period, Bitcoin has remained range-bound. The carry trade relied on sustained high US interest rates, unlikely to persist. The game has changed.

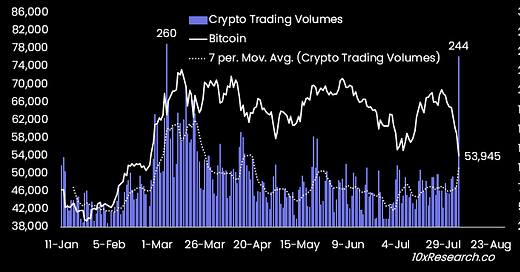

👇2-14) In the past 24 hours, crypto markets recorded a trading volume of $244 billion, the highest since March 6. Bitcoin experienced significant intraday liquidations on that day after reaching a new all-time high. Although we were very bullish in February and early March, we adopted a cautious stance following the substantial decline, as our backtest suggested an unpredictable market ahead. In hindsight, this was the correct decision.

Crypto Trading Volumes ($244 billion) vs. Bitcoin

👇3-14) Financial markets are like puzzles that need to be reassembled periodically, with new drivers of asset prices emerging. This is one of those times. Unlike the sharp declines in April and June mitigated by increased leverage, such a reversal may not occur this time.