Hyper Focused on Bitcoin: Make Volatility Great Again

Institutional Crypto Research Written by Experts

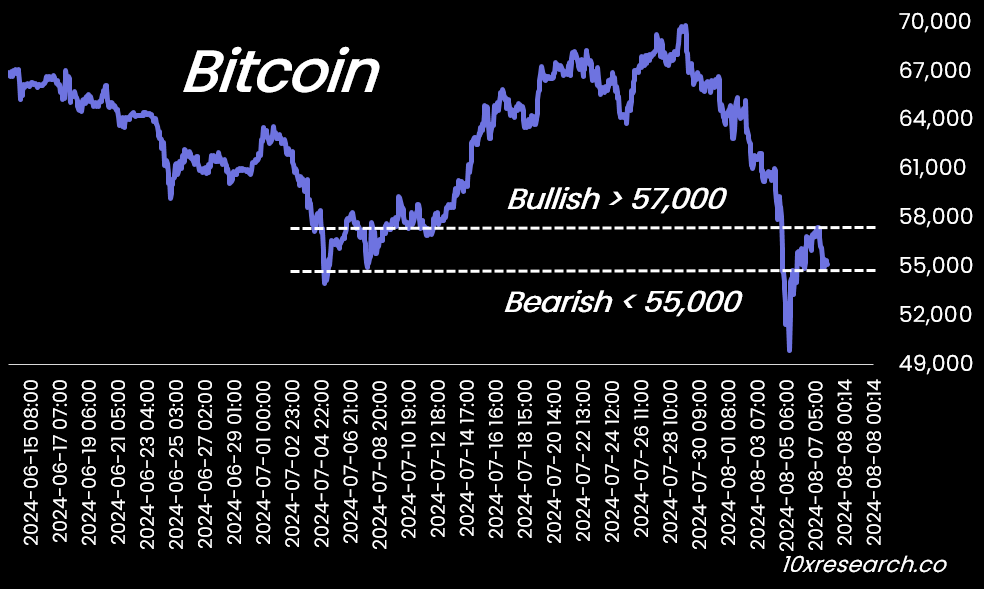

👇1-12) As highlighted in yesterday’s chart, Bitcoin breaking above 57,000 signaled a potential tactical bottom during this high-volatility period despite our medium-term caution due to weak economic data. Monday's -18% intraday drop illustrated the risks of attempting to catch a falling knife. However, as Bitcoin aimed to establish a base within the 55,000 to 57,000 range, a break above this level offered a favorable risk/reward scenario with a tight stop loss.

Chart from yesterday’s report, Bitcoin breakout > 57,000. Today: 61,900

👇2-12) This market is moving rapidly for traders. Although investors missed the chance to buy on Monday and Tuesday, we've observed significant buying activity over the past 24-36 hours. Tether has minted $1 billion, Circle has minted $1.6 billion, and Binance has reported $2.4 billion in inflows since the market drop on August 5. Additionally, a US judge has approved FTX's repayment of $12.7 billion to creditors, potentially redirecting a significant portion (50%) back into crypto by December. Bitcoin successfully closed the CME gap at 63,000, which had been open since the market drop on August 5.

👇3-12) As more institutions enter the Bitcoin market, volatility has decreased over the years, with institutions often acting as sellers of volatility by selling puts and calls to generate yield. The SEC is expected to approve Bitcoin ETF options by the September 21 deadline, potentially launching later in Q4. This development will likely attract market makers' interest and provide traders with affordable convexity for directional bets. More regulated derivatives exchanges are set to launch this year. For options insights, check out https://options-insight.com/tools/