How Bitcoin Traders Could Capitalize on a Potential Trump Victory...

...Without risking it all as Bitcoin's market structure shows signs of weakening.

👇1-14) Two prevailing theories offer Bitcoin maximalists a sense of reassurance: (a) the belief that Bitcoin’s price will increase tenfold indefinitely after each halving, and (b) the idea that a bottoming out of the liquidity cycle—marked by Fed rate cuts and rising money supply—will trigger exponential gains in Bitcoin. While these factors provide undeniable tailwinds, these theories are overly simplistic and insufficient for making informed trading decisions. These macro factors must be backed by the micro-level market structure, with the U.S. election playing a critical role this year.

👇2-14) Like a compass guides a sailing boat, macro factors can set the direction, but the ship won’t stay on course without enough wind. In crypto, that "wind" comes from market structure—everything from trading volumes and funding rates to stablecoin minting and ETF flows. Without strong momentum, crypto remains stuck in a narrow trading range. While it’s still too early to abandon hopes for a Q4 rally, effective risk management is crucial, given the current lack of market momentum.

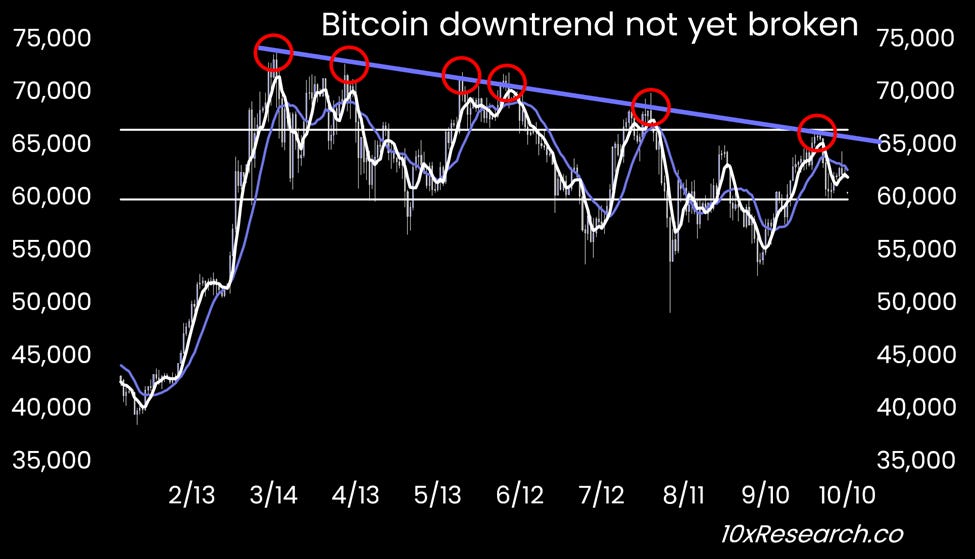

Bitcoin fails again at the downtrend resistance line.