High-End NFTs Undermined: Allure Diminished in Retail Discounters 💥

Helping EVERYONE to make better crypto investment decisions.

👇 1) The DeFi yield farming craze drove the first part of the 2021 crypto bull market and when that bull market was over, the NFT wave came (almost) out of nowhere. This brought the price of Ethers to $4,600 in November 2021.

👇 2) Buyers of the Bored Ape Yacht Club (BAYC) NFTs from Yuga Labs were expected to use those acquired commercial rights and make extra money by selling branded merchandise.

👇 3) But NFTs and other gaming-related tokens have come under pressure as there is a massive overhang from token unlocks and a need for user interaction.

🚩 Two tokens come to mind: SAND and APE.

👇 4) Today, 16% of Sandbox’s SAND token will unlock. This was one of our few bearish calls in our 2023 outlook report published on December 9 2022 when SAND was trading around $0.60. While the SAND token price has declined by -35% since our report, more downside could be expected as this $130m unlock will allow early investors and venture capitalists to sell them.

🎯 And those investors desperately need to lock in some PnL.

👇 5) At its peak in November 2021, SAND had a market capitalization of $6.8bn but $6bn has been shaved off, leaving a market cap of just $800m. Currently, the token circulation increases by +26% per year, diluting holders and risking underperforming of the overall crypto market, as we wrote in our report.

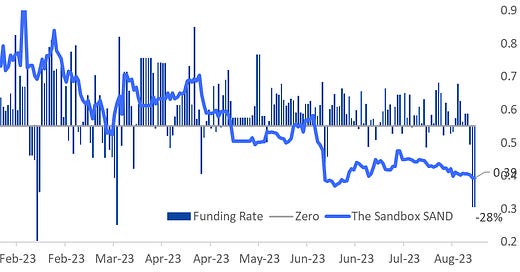

👇 6) In anticipation of this unlock, the perp futures are trading at a -28% annualized discount.

Exhibit 1: SAND token vs. its perp price (at -28% annualized discount)

👇 7) By mid-week, ApeCoin’s APE will unlock $31m or 4.2% of the outstanding token circulation. The circulation, or also called ‘emission’ has increased by +58% during the last year, diluting holders quite aggressively. At its peak in May 2022, APE had a market cap of $5.7bn but has now dropped to $731m.

👇 8) Yuga Labs was once at the top of the NFT world and dropped the 150m ApeCoin’s to BAYC holders, company insiders and venture capitalists. There has been much controversy in artists buying those BAYC NFTs whbsidized or financed by companies fueling the NFT boom.

👇 9) At its peak in May 2022, the BAYC floor price was at 153 Ether and has since dropped to sub 30 – a decline of 81%. Even in 2023, when Ethereum prices increased by +55% YtD, the BAYC floor price declined by -58%.

👇 10) It is slightly incomprehensible considering that some BAYC NFTs were changing hands at $450k and now Walmart, the sort of US discount retailer, is rolling out products with BAYC. We expected invitations to exclusive billionaire parties in Dubai. Instead, we got a T-Shirt from Walmart. Stick with quality (Bitcoin, Ether, etc.)