Have You Seen This? The Most Crucial Bitcoin Development of the Year

How ISM Data, U.S. Dollar Weakness, and Global Liquidity Are Paving the Way for a Bitcoin Breakout.

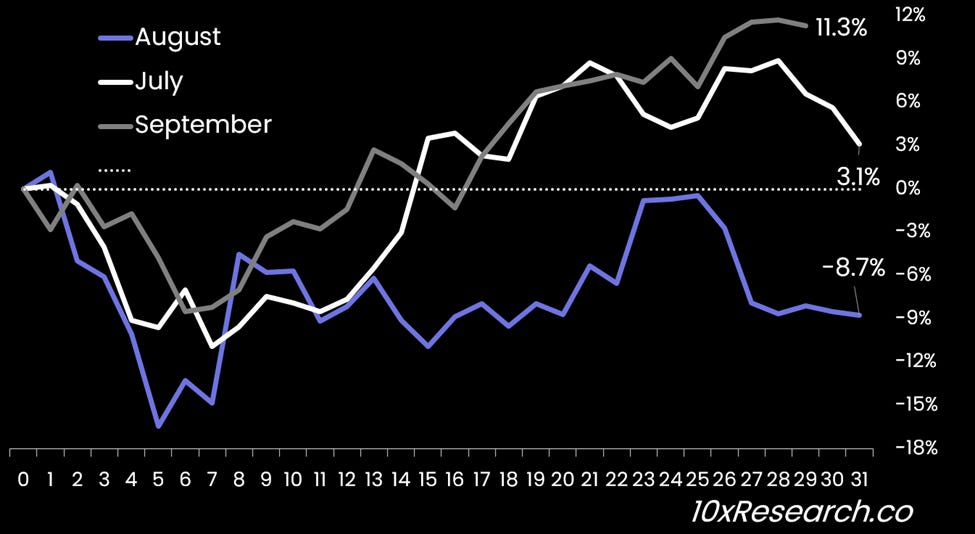

👇1-14) While most attention has been on U.S. employment data, the ISM Manufacturing Index triggered a 10% market correction during the first week of each of the last three months. Employment data, however, played a crucial role in shaping market sentiment. Weak employment figures fueled recession fears, increasing expectations for Fed rate cuts, while more robust employment data reassured investors that the economy was more resilient than the ISM Manufacturing Index suggested.

Bitcoin sold off -10% during the first five days in the last three months.

👇2-14) The ISM likely accurately reflected the economy. However, the market has been interpreting employment data through the lens of lower inflation, anticipating that this would give the Fed more room for aggressive action. In July, we highlighted that the ISM could signal the end of the Bitcoin cycle, and this month’s ISM data, released on October 1 at 10 a.m. ET, will be critical for gauging the outlook for the U.S. economy.

👇3-14) As a result, there’s likely to be some anxiety leading up to tomorrow’s data release. As usual, we’ve got a bold theory about what’s coming next.