Exposed: The Real Deal on Bitcoin ETF Flows - Must-Know Facts Unveiled!

Institutional Crypto Research Written by Experts

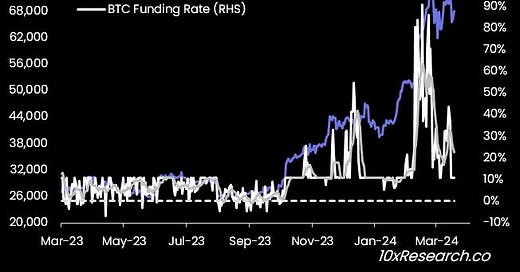

👇1-15) A self-reinforcing mechanism might have caused the Bitcoin rally from 50,000 to 70,000 from mid-February to mid-March. Expectations and inflows might have been artificially inflated, and the quality of those inflows might be weaker than the market currently perceives them to be.

If this is the case, Bitcoin will continue struggling to rally further.

👇2-15) In our report two days ago, we argued that central bankers will likely resist potential rate cuts. Indeed, last night, several regional Fed presidents pushed out their expectations for reductions, and as we argued two days ago, this is negative for Tech stocks and, ultimately, for crypto. The Nasdaq fell -1.4% last night.

👇3-15) Today’s report is not about macro (or interest rates); it is about understanding how the self-reinforcing mechanism of Bitcoin ETF inflows might have given a wrongly interpreted bullish expectation for higher prices. This might be the most crucial concept to understand right now and might set Bitcoin’s direction for the next few months.