Despite $12 Billion Of Shorts Placed Against Crypto Firms - Some Bitcoin Miners Are Attractive

While risk management remains critical, a new narrative is emerging.

👇1-12) At 10x Research, we've successfully anticipated several primary market moves this year. We accurately called the January correction and the subsequent rally towards $70,000, where we warned of a pullback to $50,000 before turning more strategically bullish in September, forecasting a Q4 breakout. Additionally, we were the first to highlight that Q1 Bitcoin ETF buying was primarily driven by hedge funds arbitraging the funding rate rather than long-only buying.

👇2-12) We also stayed ahead of the market by identifying declining Ethereum revenues, which led to a 30% drop in Ether prices. However, we didn’t get everything right. We predicted Bitcoin miners would liquidate their inventories, exerting downward pressure on BTC prices. While prices did fall, it wasn’t due to miner liquidations. Predicting the performance of Bitcoin mining stocks is one of the most challenging market calls, as Bitcoin's price and other factors influence their returns.

👇3-12) We’ve selectively become more constructive on listed Bitcoin mining stocks, as declining revenues may already be priced. With a potential breakout above $70,000, these Bitcoin-related stocks could experience a significant rally and close the gap. One example is CleanSpark, which has surged 39% since we highlighted it two weeks ago (see October 8 report). However, another Bitcoin mining stock looks promising, as we discuss below.

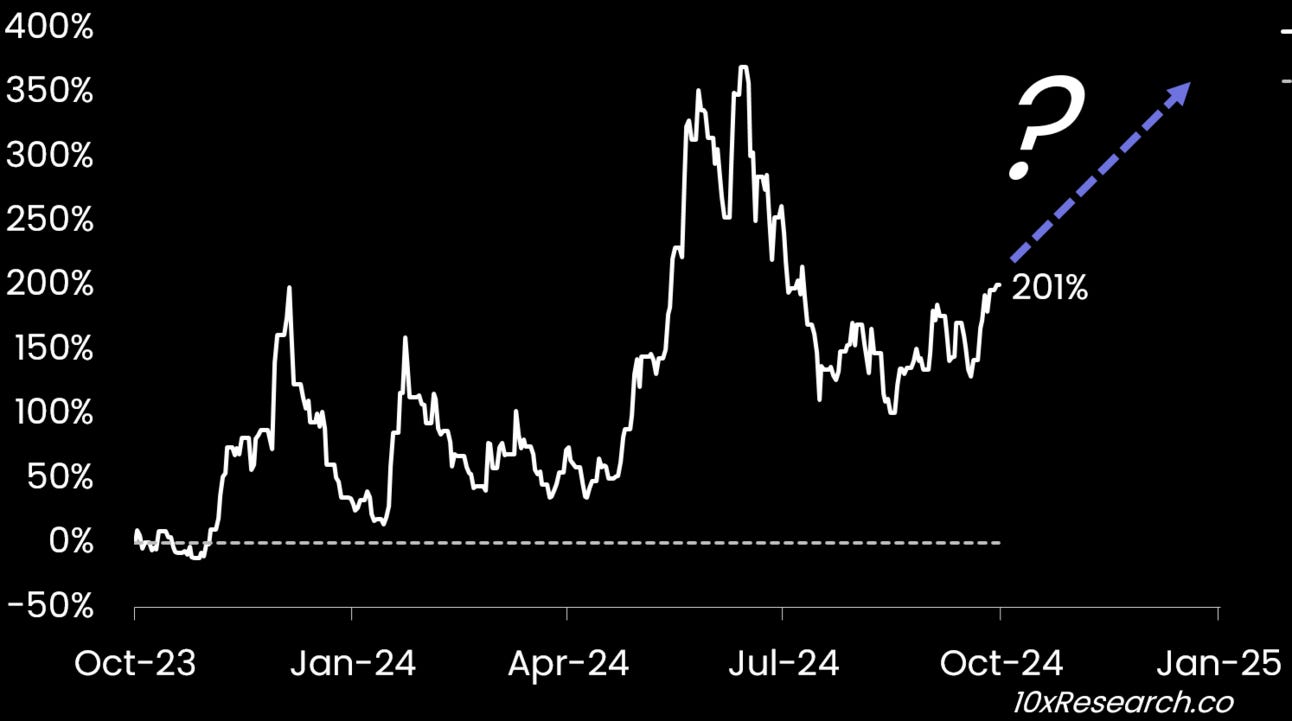

Will this Bitcoin Mining stock rally back to the July 2024 highs?