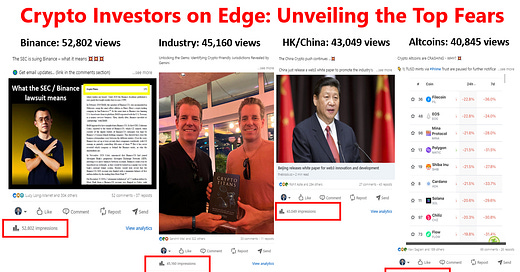

Crypto Investors on Edge: Unveiling the Top Fears 💥💥💥

Helping EVERYONE to make better crypto investment decisions.

There are 3 main concerns for investors right now: 1) What will happen to Binance (53k views), 2) Can HK (& China) step into the crypto void (43k views), & 3) Will the SEC classification of Altcoins as securities cause their demise? (41k views) & 4) investors are reading about crypto history to understand it all (45k views).

The CFTC & SEC have brought severe accusations against Binance, which could have colossal implications for the exchange. On Feb 13 2023, Paxos halted the minting of BUSD tokens. Since then Binance has retreated in various forms (changed in biz in AUS & CA, stopped zero-fee BTC trading, removed a lot of altcoin pair trading liquidity, etc.). The most worrying is its suspension of USD deposits & pausing fiat withdrawal for its Binance US.

50% of Bitcoin on exchanges have moved outside of the US due to regulatory uncertainty & for Ethereum this number is even higher at 56%. Spot volume market share for US exchanges has fallen to 21%, with perp futures markets being non-existent on US exchanges but 11x larger than spot.

US-based stablecoin USDC (Circle) market cap has fallen from $55bn to $28.4bn while Paxos-Binance BUSD has fallen from $23bn to $5.7bn. The decline in stablecoin market cap is a worrying sign as it shows liquidity leaving the industry. In contrast, the off-shore (out of US jurisdiction) based USDT Tether reclaiming its $83bn market cap.

While HK has made various efforts to offer a refuge for crypto investors, the large pools of institutional capital that were ready to enter the crypto world 2yrs ago are based mainly in the US & so far, the actions out of Asia are not decisive enough to offset the US regulatory enforcement actions & this is preventing those investors from entering the market now.

The critical driver of crypto adoption in this 2020/21 bull market was the number of downloaded crypto trading apps which showed that >600m people were interested in crypto. Download data indicates that rising prices were the most important determiner of people’s interest & with prices going down, interest is low. But the analysis also showed that Android outpaced Apple IOS downloads, a sign of lower-income users.

The fact that the US retail trading app Robinhood will end support for the altcoins Cardano, Polygon & Solana after the SEC labeled them unregistered securities is a big deal as it will even suffocate the declining retail trading interest.

As a result, we have seen perp futures open interest decline by 30% over the last weekend, signaling that altcoin interest will continue to decline. There is now a real possibility that the altcoins of the 2020/21 bull market will never make new all-time highs again.

This was part of our analysis in Oct/Nov 2021 when Bitcoin made a new all-time high, but the yield farming tokens, Solana (-94%), etc. failed to rally. MKR peaked in April 2021 & is down -90%. The 2017/18 bull market tokens are still far below their all-time highs Ripple -85%, EOS -97%, etc.

While there is always money to be made in crypto, our view is that Bitcoin could make a new high but altcoins of the 2021 bull market will unlikely make new highs.

This is where crypto history is so vital to understand as the book ‘Crypto Titans’ explains the revolving door of crypto exchanges, the different drivers of the 4 crypto bull markets (2011, 2013, 2017 & 2021) & clearly shows that REGULATION was a driving force to stop all those bull markets.

(Amazon: https://amzn.to/3qkleym)