Crypto crash averted? Or Altcoins still at risk? 💥

Helping EVERYONE to make better crypto investment decisions.

Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a signed copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

👇 1) Financial markets are indeed changing fundamentally. The notable difference between this crypto bear market and the previous three is that global institutional players embrace blockchain technology and roll out applications that will bring in hundreds of millions of customers.

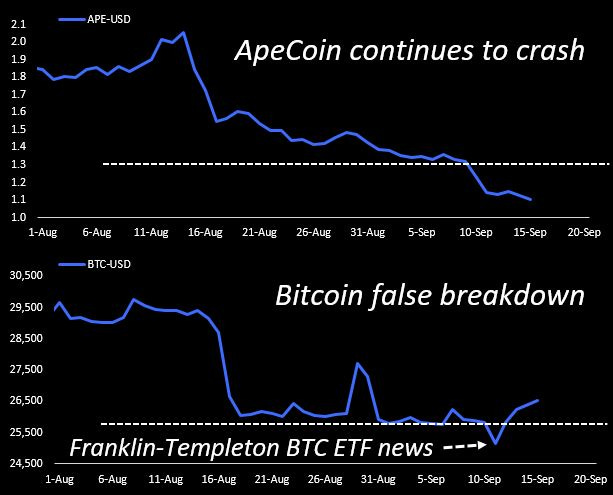

👇 2) German banking giant Deutsche Bank, offering customers cryptocurrency custody solutions through their partnership with infrastructure platform Taurus gave Bitcoin new upside momentum. But $1.5trn asset manager Franklin Templeton’s spot Bitcoin ETF filing caused Bitcoin prices to reverse earlier this week. BTC has rallied +5% since the announcement. The Bitcoin price action now signals that the breakdown on Monday might have been false.

👇 3) This timely news release averted Bitcoin prices from falling further and set off, what could have been, cascading liquidations as the $25,000 price is such a significant psychological level. The Franklin-Templeton news was released near $25,100 when the market became aware of Blackrock’s Bitcoin ETF filing in June. Hence, this $25,000 level is of the utmost importance now and appears to be defended by price-impacting news.

This reminds us of 2017:

👇 4) “In 2017 Bitcoin prices rose from one thousand to almost twenty thousand dollars. Half of the gain was associated with coordinated price manipulation. Tether was used to buy Bitcoin when the cryptocurrency was losing momentum and prices needed to be stabilized. Using data that tracked public ledgers of Bitfinex transactions, fifty percent of all the Bitcoin rallies could be traced back to one percent of trading activity in Tether.” (See more details in the book ‘Crypto Titans’ page 132 for more details, Amazon).

👇 5) This week, Bitcoin’s dominance has increased to 49.1% - nearly half the crypto market value has accrued to Bitcoin – despite various altcoins' advanced technological (and marketing) advancements.

👇 6) The Bitcoin funding rate movements give the impression that this week’s BTC move was spot-driven – and not futures-led. Indeed, a timely move out of $200m USDC appears to have caused BTC to rally near the lows. A glance at various funding rates gives us the impression that the rally is based on weak market internals.

👇 7) While Bitcoin increased in value again, some altcoins are still at risk, as we pointed out in our September 5 market update. The ApeCoin unlock is less than two days away and prices have declined further. The ApeCoin token has dropped -18% since our update, and the unlock will release $45m (or 11% of the outstanding tokens), which will likely see selling pressure from VCs. Tactically, we could see a rebound when the unlock happens.

👇 8) There is some real alpha being made by trading Bitcoin on the long side and selling altcoins ‘tactically’ against it, especially altcoins with event risk – such as ApeCoin.

👇 9) Crucially, Ethereum has also climbed back into the range, setting the direction for the broader altcoin market, but we would continue to warn that IF Ether breaks below $1,600, a steeper decline might still loom.

👇 10) Similar to the well-timed price action in BTC in 2017, investors should take advantage of the well-timed news items about a potential Bitcoin ETF approval that appear to keep coming exactly when the market needs them.