Black Friday SALE - only until November 30

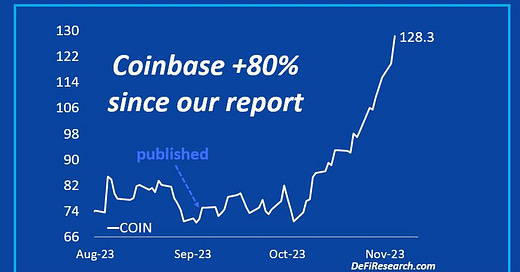

Summary: On September 28, we published our report “Bitcoin Miners, the Ultimate Bet for 2024?” which included potential upside targets for other Bitcoin-related stocks like Galaxy and Coinbase. Since our report two months ago, Coinbase has rallied by +80%. The rally in Coinbase is a sign of pent-up demand from TradeFi investors who want crypto exposure - this is why any Bitcoin spot ETF will be a big success.

Analysis:

👇 1) The difference between our digital asset research and everybody else is that we translate the on-and-off chain noise into actionable trading opportunities. While everybody focuses on pointing out that Bitcoin went up or down last week, we interpret the events and formulate an investment thesis that is forward-looking and can generate returns for the portfolio.

👇 2) Frequently, we receive messages like this one a few days ago from Victor: “Thanks to you, I bought a lot of Coinbase back then”. On September 28, we published our report “Bitcoin Miners, the Ultimate Bet for 2024?” which included potential upside targets for other Bitcoin-related stocks like Galaxy and Coinbase.

👇 3) Since our report two months ago, Coinbase has rallied by +80% - undoubtedly helped by the perceived market share gains as Binance is going through a ‘corporate restructuring’ – but most importantly, because the Bitcoin bull market is gaining traction and Coinbase could be a key beneficiary of any US-listed spot Bitcoin ETF.

👇 4) We have been outspoken about this year’s rally, and the 30-minute presentations we gave between December and January/February turned into 60-minute Q&A, but our bullish view has turned out to be spot on.

👇 5) Coinbase still needs to take market share from Binance as the US company mostly operates in the US and predominantly offers spot trading. Spot volume for Coinbase is around $1.5bn per day, while Binance trades $8-10bn and $20-30bn in derivatives.

👇 6) The rally in Coinbase is a sign of pent-up demand from TradeFi investors who want crypto exposure - this is why any Bitcoin spot ETF will be a big success.

👇 7) As we enter the last month of the year, we remain bullish as Bitcoin tends to rally by +12% in December, and our year-end target, which we set in early 2023, with expectations that Bitcoin could finish the year at 45,000, appears probable.

👇 8) Our 2023 outlook report suggested this would be a bullish year for risk assets (Nasdaq + Bitcoin) as we expected inflation to decline sharply. This was a non-consensus call, as many market participants expected a recession. Some of our recommendations included Bitcoin (+126% YtD), Grayscale’s GBTC (+280% YtD) and Solana (+480%). I know many who have bought those upon our recommendations.

👇 9) Soon, we will start releasing our 2024 outlook report. We will release our ideas and thoughts for 2024 to our institutional clients and share the main ideas with our readers on our substack distribution list (link in the comment section). We will NOT share it on LinkedIn, so if you would like to receive it, it is best to subscribe to our email list.

👇 10) What a great year it has been!

🤫Binance / CZ guilty – what it means for the Crypto industry

SHARE WITH A FRIEND

Thanks for reading. If you liked today's brief, we'd love for you to share it with a friend.

Partner with us

DeFi Research is much more than just this newsletter: we’re a full-blown one-stop shop for engaging with modern investors. Mail us for partnership deals: info@defiresearch.com

WANT TO SPONSOR THIS NEWSLETTER?

Over 10,000 subscribers are throwing a party, and your brand is invited!

Tap into our network of savvy (and good-looking) crypto & Web3 enthusiasts eager to learn and invest.

All content provided by DeFi Research is for informational and educational purposes only and is not meant to represent trade or investment recommendations.