Buy or Sell Bitcoin? Will the FOMC Meeting spark crypto chaos? 💥

Helping EVERYONE to make better crypto investment decisions.

Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a signed copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

👇 1) Realized volatility (30-day) averages 42% for Bitcoin in 2023. In December 2022, we suggested selling a weekly straddle (sell puts and sell calls) strategy as our top strategy for 2023 that takes advantage of a narrowly trading Bitcoin price.

👇 2) This strategy continues to perform well. Bitcoin’s +60% YtD returns can be traced back to just three weeks (one in January, one in March, and one in June), and even around significant events, Bitcoin is not showing the volatility that market participants are used to.

👇 3) As a result, realized and implied volatility have declined to just 35%. The FOMC committee is meeting over the next two days, and the team around Chair Powell will decide if US interest rates need to be increased or if the Fed will remain on pause.

👇 4) Based on Bitcoin options market pricing, traders expect that BTC will only move by 2.8% this Friday, a sign that nobody expects any market-moving comments from Chairman Powell. In 2023, Bitcoin has only rallied by +1% shortly after the FOMC meetings and increased by +3% one week later.

👇 5) While Bitcoin prices appear to want to move higher, Powell’s comments could spook the market as last week’s CPI data was higher than expected, and oil, bond yields, and the dollar are trading higher. We still believe that inflation will continue to trade lower and remain bullish on the market outlook.

👇 6) News that Citibank is about to debut its token service, which turns customer deposits into digital tokens and focuses on trade finance and cash management, is another sign that the big financial institutions continue to embrace blockchain technology. Undoubtedly, blockchain is seen as a technological improvement to the current financial system, and that’s why the probability of another bull market occurring is 100%.

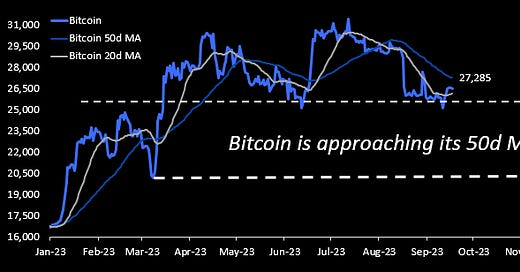

👇 7) Tactically, our Bitcoin MP Greed & Fear index has bottomed, making us more constructive with anticipation of higher prices. In addition, Bitcoin is approaching the 50-day moving average ($27,285), a medium-term bullish signal.

👇 8) Technically, if Bitcoin declines below $25,000, then prices could fall to $20,000, and prudent risk management is paramount to protect capital. This time, the risk was averted as another timely Bitcoin ETF news release at $25,100 shifted the market back into upward momentum.

👇 9) The market became aware of Blackrock’s Bitcoin ETF filing in June, also at $25,100. Is it a coincidence, or is someone defending the $25,000? This is a critical technical level, as we have pointed out during the last few months.

👇 10) For the last month, Bitcoin has traded around $26,000 and is building a base. First, a failed bullish attempt and then another failed bearish attempt. The odds of breaking the range to the upside are higher (Citibank news, Bitcoin ETF news, Greed & Fear, 50d MA), and our trading signals indicate that historically, Bitcoin could rally by +9% once it breaks above $27,000.