Bitcoin's Path to $66,000 Blocked Despite Strong Macro Tailwinds – Here's Why

Institutional Crypto Research Written by Experts

Bitcoin's Path to $66,000 Blocked Despite Strong Macro Tailwinds – Here's Why

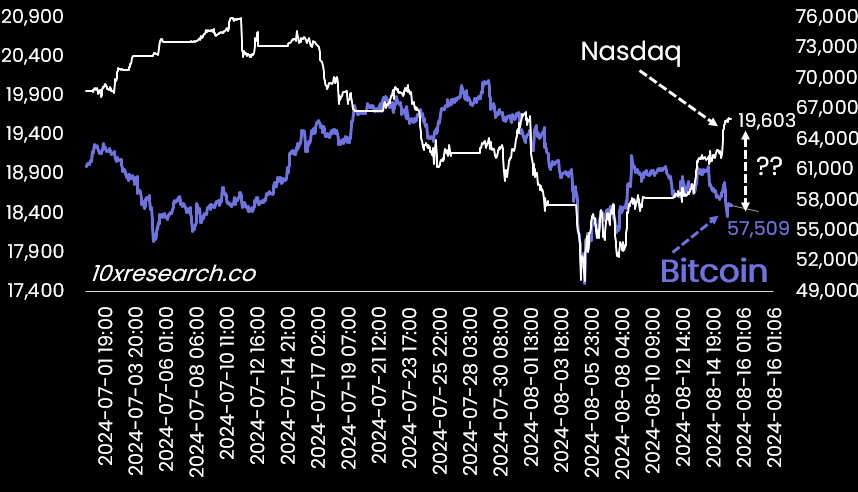

👇1-12) Traders are perplexed by the current disconnect between the strong rally in U.S. tech stocks and the underperformance of the crypto market. As we noted recently, this divergence—where tech stocks surge while crypto trading remains subdued—aligns with our expectations based on the release of upbeat U.S. macroeconomic data this week.

Nasdaq (LHS) vs. Bitcoin (RHS) - Nasdaq rally implies BTC at 66,000

👇2-12) Macroeconomic factors or liquidity conditions do not solely drive the crypto market's behavior; internal market dynamics and the underlying market structure are equally crucial in determining price movements. Understanding these elements is vital to predicting where crypto prices may head next.

👇3-12) We also anticipated that Bitcoin would retreat into the $50,000 to $60,000 trading range, with the post-August 5 crash rebound stalling around the resistance zone between $60,000 and $61,000. This slowdown could allow oversold technical indicators to reset, increasing the likelihood that Bitcoin might retest the August 5 low near $50,000—a move that would catch many off guard. There are still opportunities to profit in the crypto market, but the timing isn't optimal.

👇4-12) We anticipated a 2.9% CPI, which the actual report confirmed. However, we were concerned that even a lower CPI—while likely—wouldn’t be sufficient on its own (see the August 14 report). Over the past four months, we’ve consistently warned that the $60,000 to $70,000 range could represent a topping pattern, as suggested by monthly indicators. Although the rebounds in May, June, and August occurred faster than expected, we accurately predicted each correction.