Bitcoin traders still expecting a rally back to 30k 💥💥💥

Helping EVERYONE to make better crypto investment decisions.

Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a signed copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

👇 1) When Bitcoin dropped from 29,500 to 26,000, nearly $3bn in open interest was liquidated – this was ~30% of the futures positions. Arguably, positioning is much cleaner now, and a break above 26,300/500 could reawaken the animal spirits and push prices back up.

👇 2) Derivatives data shows a huge call ‘wall’ between 30k to 35k, and once a tiny rally gets going, the option gamma could cause a violent rally back to 30k as market makers will have to buy Bitcoin to hedge themselves. Not a short squeeze but it does not take much to get a rally going.

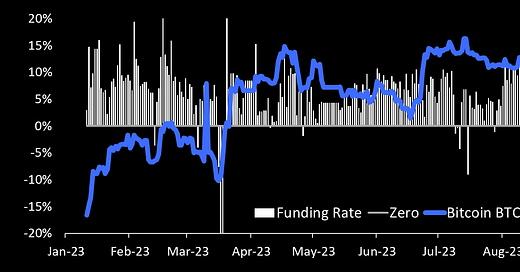

👇 3) The perpetual futures funding rate has also slightly increased again, indicating that bullish traders are back: nothing extraordinarily excessive, but a healthy +2-3% annualized. Taken together with the futures open interest data, traders have room to build long positions.

👇 4) Our MP Greed & Fear Index is still trading at ‘fear’ levels with a reading of just 3% (0-100% range) and the RSI is rebounding back to 28%. Bitcoin is oversold here. There is now a tiny technical divergence occurring that could increase the upside vs. downside odds.

👇 5) Bitcoin’s dominance is 48%, up from 38% since the beginning of the year. All these SEC lawsuits and Treasury enforcement actions against DeFi and the IRS proposing tax rules defining DeFi platforms as brokers are supporting Bitcoin. The Sam Bankman-Fried trial is also just 6 weeks away, this will bring back a lot of media attention to the crypto space.

👇 6) Bitcoin would also have direct upside beta exposure to any US-listed physical Bitcoin approval by the SEC. The Grayscale Bitcoin Trust (GBTC) has narrowed its net-asset-value discount from -48% to just -26%, which implies a 60% chance that a Bitcoin ETF would be approved based on our estimates.

👇 7) The US macro backdrop continues to be highly favorable to risk assets, as we pointed out in December 2022. Inflation will continue to fall and the Fed appears to be on hold for the time being, that’s what Fed Chair Powell implied last week, in our view. The Fed’s fasted rate hiking cycle in 50 years will likely set up a multi-year deflationary boom and we expect new all-time US stock market highs by the end of this year.

👇 8) China is the most significant risk economically, as we pointed out two weeks ago and the USD/CNY continues to climb higher. China's doomsday stories must be near an extreme and the authorities appear to acknowledge the problems and are trying to support the economy. Recently we have seen stories about stock trading stamp duty being cut, some property stimulus attempts, and local fund managers being ‘encouraged’ to NOT sell shares.

👇 9) Price levels traders should be monitoring: USD/CNY should NOT trade above 7.31 (last 7.29), Bitcoin should NOT trade below 25,800 (last 26,080), 10-year US treasury yields should NOT trade above 4.33% (last 4.19%), Nasdaq should NOT trade below 14,600 (last 15,050).

👇 10) With tight stop losses, we would be long Bitcoin, expecting lower treasury yields and a rally in US tech stocks. These are all very tight ‘stop-loss’ levels that traders should be monitoring. We expected a 10% correction by the end of the summer, which we have gotten, and with the appropriate risk management approach, traders can try to be long again.