Bitcoin Traders Speculate on Potential Bullish Impact of $2.5 Billion

Institutional Crypto Research Written by Experts

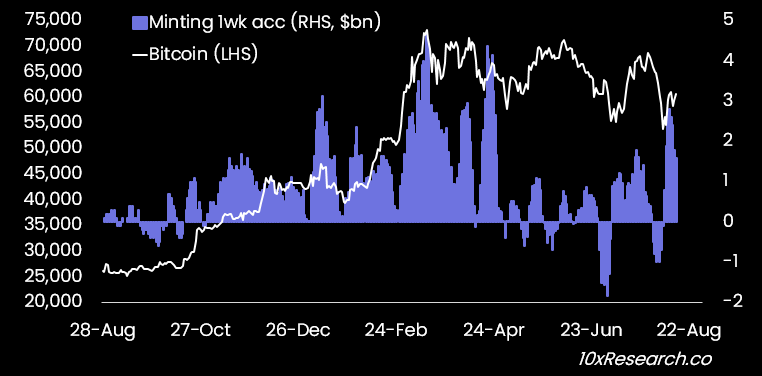

👇1-10) Monitoring and analyzing crypto money flows is crucial for assessing market conditions that can act as tailwinds or headwinds for Bitcoin and other cryptocurrencies. Traders are often caught off guard by price crashes, overlooking the critical signals these flows offer. However, the inverse is also true; a sustained increase in money flows can drive higher prices, but many also miss these indicators.

👇2-10) Since broad money flows largely paused in early April 2024, the subsequent price correction was expected. However, a resurgence in certain money flows helped lift prices as markets approached bottoms. The critical factor was monitoring the sustainability of these flows, as rallies often lost momentum without continued support.

👇3-10) Last night, Tether minted $1 billion in USDT, though it appears to be inventory building rather than immediate issuance, as we detailed in our book, Crypto Titans: How trillions were made and billions were lost in the crypto currency markets. However, nearly $2.8 billion was issued by Tether and Circle earlier last week, indicating that some institutional investors are injecting fresh capital into the crypto market. If this trend of issuance (not just minting) continues, Bitcoin could see further gains.

Bitcoin (LHS) vs. 7-day minting impulse (buying the dip in April + Aug)