Bitcoin Traders: Crucial Moves Before Tonight's CPI and FOMC

Institutional Crypto Research Written by Experts

Does your crypto card offer no rewards? KAST’s early adopter program gives 3-9% rewards on spending. 10X subscribers though, get up to a 3X multiplier taking rewards to 27%!

EXCLUSIVE OFFER: Join the waitlist & use campaign code “10X”

https://kast.finance/

When we see the code, we’ll fast-track you to onboarding. Be quick—the early adopter program has limited spots, and phase 1 entry closes June 21st.

👇1-12) Tonight’s double macro-event of CPI and FOMC appears to be a coin flip after last week’s higher-than-expected US employment data, which caused most Wall Street banks to push out their first rate cut expectations towards September, if not later. Although the interest rate-sensitive Nasdaq has continued to make new all-time highs, Bitcoin has declined from 71,000 to 67,000.

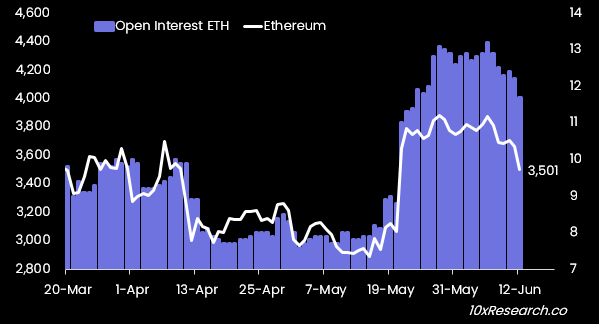

👇2-12) Bitcoin could break to new highs if prices climbed above 72,000 (71,946). However, we have warned that over-positioning in Ethereum (leveraged) futures could cause unwinding with negative implications for Bitcoin (here) and preferred Bitcoin over Ethereum (last week BTC -5% vs. ETH -9%). Our report on Monday showed the chart below, as Bitcoin traded dangerously close to the uptrend line (purple).

Bitcoin broke the uptrend (purple)

👇3-12) Instead of repricing Wall Street’s interest rate expectations, it appears more likely that SEC Chair Gensler’s comments that Ethereum ETF S-1 approvals would take time started the unwinding of leveraged long positions. The enthusiasm around an Ethereum ETF has materially declined, and the ETH/BTC ratio continues to fall within its well-defined downtrend.

Excessive Position building ($bn, RHS, purple) in Ethereum (white, LHS)