Bitcoin Surges Again: Traders Asking If This Bull Market Can Last?

Institutional Crypto Research Written by Experts

Header: Empower Your Trading with Real-Time Blockchain Insights

Blurb: QuickAlerts revolutionizes the way traders and developers interact with blockchain data. By offering real-time alerts for on-chain events, it provides the tools necessary to make informed DeFi trading decisions, integrate blockchain event-driven logic into workflows, and enhance app functionalities with up-to-the-minute data.

👇1-12) During our tenure as portfolio managers at Millennium, one of the world's premier hedge funds renowned for its stellar risk-adjusted returns and stringent risk management, we often heard invaluable advice: “The market opens every day." Despite the allure of quick gains (FOMO), we remain committed to rigorous risk management and thorough analysis, ensuring opportunities are always ahead without compromising our standards.

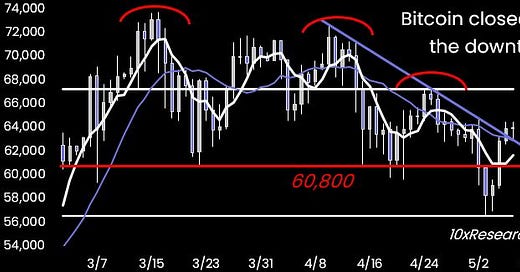

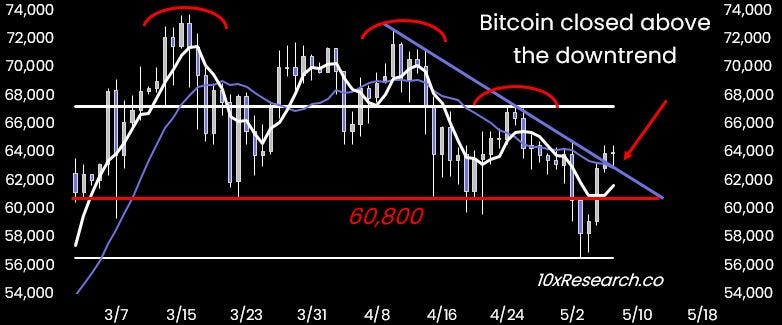

👇2-12) Bitcoin is roughly back to the same level (64,000) when we emphasized that prices could fall back to 52,000/55,000 a week ago. In that report (on April 25), we showed how Bitcoin tends to sell off on higher inflation data BUT rallied after the FOMC meeting on March 20 – until another higher inflation data point was released. Bitcoin did decline but narrowly missed our entry buy zone by a tiny 3% margin (actual low 56,500). The decline from 68,300 when we emphasized cutting longs was -17%.

👇3-12) Identifying the right entry point is key in achieving a high-risk-adjusted return, especially in the absence of a larger bull market where prices can surge 2-5x. When the 60,000 level was breached, the nearest technical support was the 52,000/55,000 area. Interestingly, the Bitcoin rebound wasn't triggered by the FOMC meeting but by a well-timed comment from Blackrock about the (apparent) growing interest of sovereign wealth funds and pension funds in Bitcoin ETFs, which then accelerated on weaker employment data on May 3.