Bitcoin on the Verge of Mass Adoption: Crypto Trading Volume in Korea Surpasses Local Stock Market by 85%

It’s not only strategic long-term investors becoming highly active—retail investors are also joining the frenzy.

👇1-11) In our September 24 report, “12 Key Bitcoin Catalysts Set to Skyrocket Prices to Record Highs in Q4!”, we highlighted that “by November 14, we expect to hear that several additional U.S. pension funds have started investing in Bitcoin, signaling growing long-term demand from institutional investors.” Examples of sovereign Bitcoin holdings include El Salvador, with 5,750 BTC, and the Kingdom of Bhutan, which holds an even larger position of 13,030 BTC, valued at around $1 billion.

👇2-11) The takeaway is clear: 2024 has seen a significant expansion of Bitcoin holders, with sovereign entities and pension funds increasingly entering the market and strengthening the base of long-term investors. Soon (next few days), 13F filings should reveal which pension funds or large asset managers acquired Bitcoin in Q3. It’s not only strategic long-term investors becoming highly active—retail investors are also joining the frenzy.

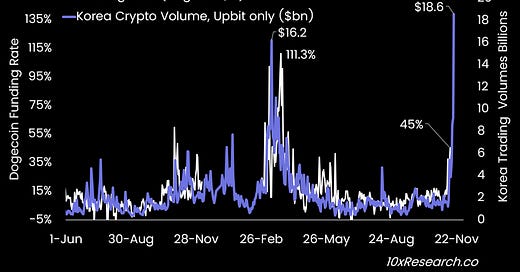

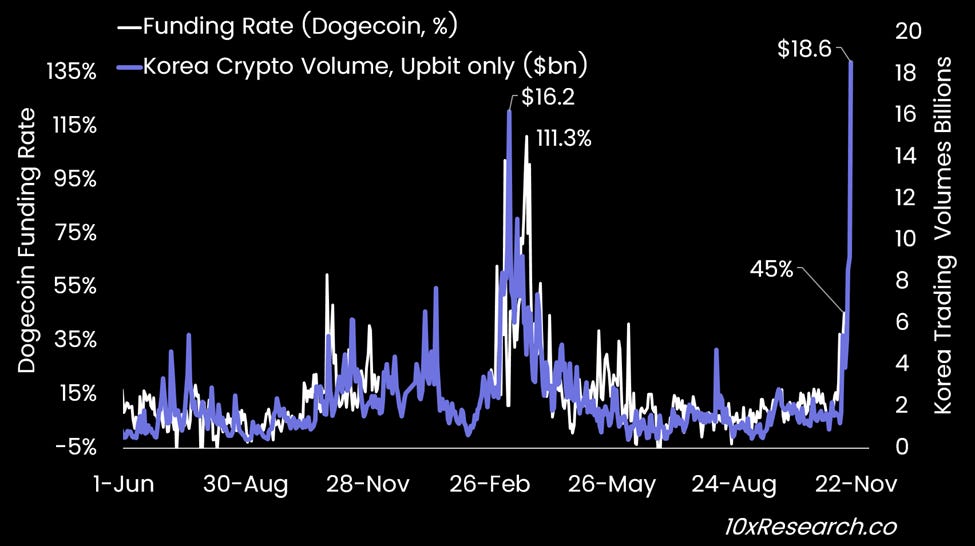

👇3-11) MASSIVE explosion in Korean retail crypto trading with volume on UPbit reaching $18.6 billion which does not include another $7.3 billion that was traded on Bithumb - the two largest Korean exchanges. Overall, Korean retail traded more than $26 billion worth on spot exchanges while all local Korean stocks trade only $14 billion – that’s 85% more than stocks. Since the Trump election, Dogecoin has been the coin with the most volume and traded $8 billion during the last 24 hours – or 57% of ALL the stocks in Korea. Volumes of $18.6 billion on UPbit have eclipsed the $16.2 billion in early March.

Korea crypto retail volumes exploded - correlated to Dogecoin funding rate