We specialize in delivering top-tier research at the crossroads of digital assets and financial markets. Our institutional-grade research stands out for its actionable insights that frequently lead to profitable outcomes for our readers.

10x Research offers three distinct services:

1) newsletter,

2) institutional-grade research, and

3) research services for institutions.

Are you a subscriber to either 1) newsletter or 2) institutional-grade research?

👇 1) Seasonal influences have been vital to Bitcoin’s Q4 performance. Our analysis from September 21 indicated that “October tends to be a KILLER month for Bitcoin,” with average +23% returns. That’s why we went ‘all-in’ on the ‘Bitcoin Miners, the Ultimate Bet for 2024’ in our September 29 report.

👇 2) A few days later, our trading models registered ‘Bitcoin and Ethereum BREAKING OUT' on October 2. Crucially, while those were already ‘overbought’ by technical measures, we showed how, on previous occasions, prices tended to rally +20-30% more once similar overbought conditions were in place. We remained bullish.

👇 3) October was an eventful month with several key events occurring around the ETF ( we will write a more detailed report for our subscribers, to be published within the next 24 hours, and that will explain what will likely happen in January to Bitcoin).

👇 4) By October 24, we wrote about ‘Bitcoin 45,000 – FOMO is hitting the Market’ as Bitcoin broke above the July 2023 resistance level of 30,000 - calling for a +50% upside into Christmas.

👇 5) By October 26, we wrote ‘This Bitcoin Mining Stock might have +330% Upside’ – this stock has returned +150% since our recommendation. The gap between Bitcoin and the share price offered an outsized return opportunity as there was a clear, temporary explanation that would eventually be resolved.

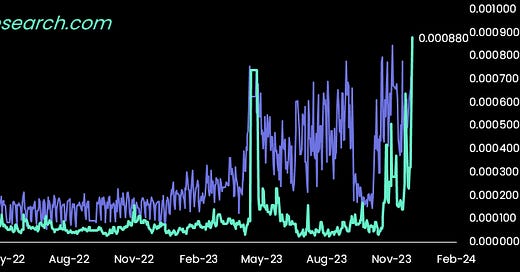

👇 6) The exciting aspect for the Bitcoin mining companies is that their rewards are cut in half by April/May (next halving). Competition to mine Bitcoins has skyrocketed, with the hashrate increasing from 220M TH/s to 508M TH/s, Bitcoin transaction fees have risen to $37 per transaction – the highest level since April/May 2021 – the peak of the previous DeFi bull market (NFT bull market made another peak higher by October/November 2021).

👇 7) There are now 350,000 transactions inline, waiting to be confirmed, and users are paying higher fees to get their transactions (+31% vs. 2yr average, despite being limited by blocksize) included within the next block. The block reward has increased to $420,000 with miners generating $63.3 million in fees –$23bn per year. Thanks to ordinals, Bitcoin miners generate high fees (+287% vs. 2yr average), so mining companies outperform Bitcoin.

Exhibit 1: Number of transactions last 24h (LHS), Bitcoin fee per transaction (RHS)

👇 8) On November 3, ‘Bitcoin and the Santa Claus Rally: 45,000 possible’, we reiterated our long-held view (since February 1) that Bitcoin would reach 45,000 by Christmas. The report showed our analysis, which projected ‘super strong returns’ from October to December 18.

👇 9) We also projected another +12% rally in December, which was quickly achieved. Still, as we entered the December 8 to December 10 period, we noticed that our market structure indicators and money flow data lacked follow-through. We warned on both days that Bitcoin would likely sell off from 45,000 and remain stuck between 40,000 and 45,000 until year-end.

👇 10) Despite Bitcoin being range-bound, the Bitcoin mining stocks are still performing well and are on fire with extraordinarily high fees being generated. This benefits the miners’ share price - as we wrote on September 29. If you are keen to read our views in the future, there is only one remaining question: have you subscribed to any of our two services: 1) newsletter or 2) institutional-grade research?