Bitcoin Nears $60,000: Key Factors Behind the Drop

Institutional Crypto Research Written by Experts

Join the waitlist & use campaign code “10X” (CLICK HERE)

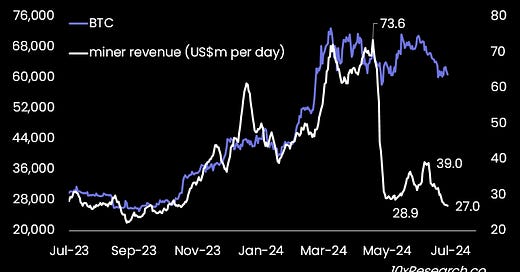

👇1-11) The weekend Bitcoin pump might have been necessary to reset the oversold (short-term) technicals before the downtrend could resume. We worry primarily about longer-term technical issues, which indicate a more pronounced topping formation. Our Monday report, ‘Is the Bitcoin Trump Pump sustainable?’ reiterated our medium-term view for a deeper downside correction.

👇2-11) However, the combination of longer-term technicals, on-chain signals, flows (especially from miners’ inventory), and market structure data could overwhelm, at least in the near term, the potential bullish arguments from the US Presidential election tailwind and eventual interest rate cuts matter less (at this point). Bitcoin is back in the 60,000 to 61,000 range, which, if broken, could cause liquidation.

👇3-11) During extremely low volume periods, the well-timed weekend pump caused waves of liquidations on the upside (shorts being stopped out). Simple attempts to trigger those buy stops were successful, but there is now less upside risk from short covering—quite the contrary - the downside risk is now real.