👇1-11) The Bitcoin network appears to be doing much better than initially feared after mining rewards were cut in half on April 20. The Bitcoin halving coincided with the launch of Runes, which allows users to mint tokens on top of the Bitcoin network, generally meme-coins.

👇2-11) This temporarily raised Bitcoin transaction fees after the halving, as Runes generated over $135m in fees in the first week after the halving. Not only did Bitcoin miners benefit from those extra fees, but it also increased the difficulty of Bitcoin mining, which only started to decline in early May.

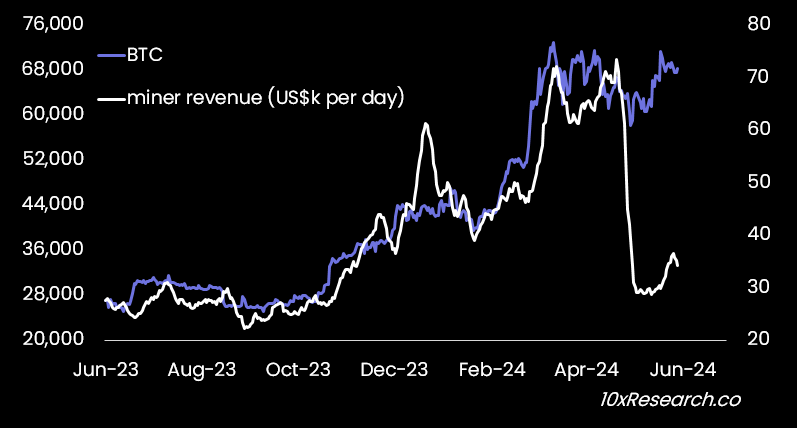

👇3-11) A higher difficulty signals that competition is fierce and winning mining rewards has become more complex. At the same time, daily miners' revenue dropped from $70m to just $30m. Expectations were that the hash rate would see a significant setback as inefficient miners would be forced to switch off machines.

👇4-11) Bitcoin miners’ revenue has marginally increased to $35m, which still signals a small distress signal to investors. Share prices of Bitcoin miners were expected to decline, as they did. But now something interesting is happening – as we explain below: