Bitcoin Miners, the Ultimate Bet for 2024? 💥

Helping EVERYONE to make better crypto investment decisions.

Many have been asking, so for the next 30 days, for new yearly subscribers of our substack updates, we will send a copy of the book ‘Crypto Titans: How trillions were made and billions lost in the cryptocurrency markets” to their postal address (no extra shipping and handling fees).

👇 1) On March 30, 2023, we unveiled our crypto portfolio with the report, ‘How to Achieve +112% Upside Potential’. By July 4, 2023, this portfolio had remarkably skyrocketed by +63% in just three months, marking the closure of numerous undervaluation opportunities. However, a mere 10 days later, most publicly traded Bitcoin mining companies peaked out and began to experience a decline.

👇 2) A few months later, the stark underperformance of listed digital asset companies has motivated us to revisit the investment opportunities in the Bitcoin mining space.

👇 3) While we maintain a positive outlook for Bitcoin, despite signals indicating the SEC’s likely delay of a US-listed Bitcoin ETF until January 2024, the prospect of October, historically a robust month for Bitcoin with average returns of +20%, and the anticipation of the Bitcoin halving event (expected in April 2024) continue to contribute to our optimism. We remain bullish on the prospect of more positive price movements for Bitcoin.

👇 4) In light of all this, based on the current price of Bitcoin, these stocks are trading at a -33% discount and offer a +52% upside. Our regression analysis would value these 10 stocks +97% higher if Bitcoin moves back to $30,000, or +572% higher if Bitcoin makes a new all-time high and trades at $70,000. MicroStrategy and Grayscale’s Bitcoin Trust (GBTC) only have limited outperformance potential, and contrary to tokens such as DOT-USD (Polkadot) — which we use as a proxy — could offer a 10x return if Bitcoin reaches $70,000.

👇 5) At the same time, it’s worth noting that tokens have considerably more risk than (listed) stocks.

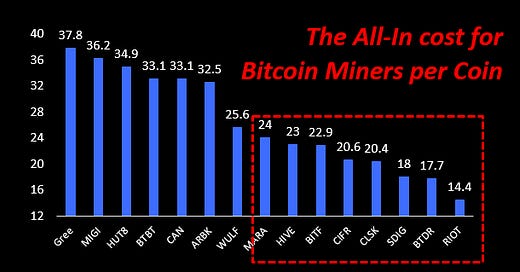

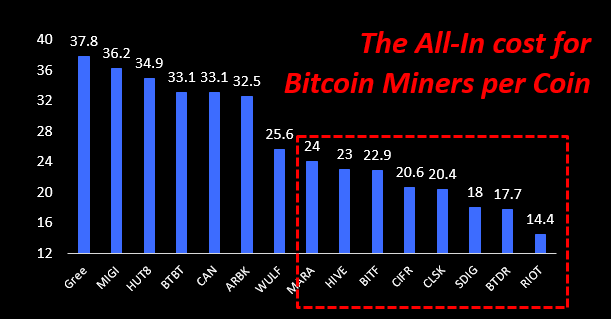

👇 6) Marathon Digital’s realized hash rate consistently ranged between 75 to 80% for Q1 and Q2 of 2023. This was a significant improvement from July 2022 when it was as low as 11%, causing production costs to skyrocket to $43,000 per coin in Q3 2022. Their all-in costs for Q1 2023 were significantly lower at $22,100, increasing slightly to $24,000 per coin in Q2 2023 due to better operational efficiency.

👇 7) Of the 7,400 coins they produced, 6,300 (85%) were sold. Previously known to ‘hodl’, the company now holds 12,500 coins in inventory, providing room for additional sales.

👇 8) With overhead costs between $4,000 and $5,000, Marathon Digital may face an all-in cost of $29,000 after the halving. Therefore, despite the anticipated drop in revenue after April 2024, Marathon might be able to sustain these changes if Bitcoin rises above $30,000.

👇 9) Among operators with the lowest production cost per Bitcoin are Stronghold Digital Mining, Bitdeer Technologies, and Riot Platforms. They boast implied all-in costs of $18,000, $17,700, and $14,400 per coin, respectively, compared to Marathon Digital’s cost of $24,000.