Bitcoin, MicroStrategy - NOT every dip presents a buying opportunity...

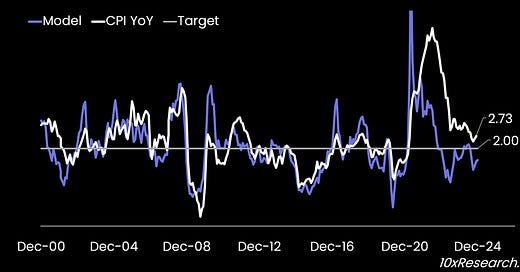

Our inflation model still signals benign CPI but....

👇1-14) While we expected a slightly hawkish tone from Fed Chair Powell, the market was rattled by the Fed’s updated median interest rate forecasts, which projected increases not only for 2025 but also for 2026 and 2027. Powell's suggestion that it could take 1-2 years to return to the 2% inflation target further reinforced the hawkish sentiment. The estimates for the later years were shocking, signaling the likelihood of higher interest rates for an extended period.

👇2-14) As a result, stocks declined by 3%, and Bitcoin dropped by 4%. Altcoins, already struggling due to a lack of retail trading activity, suffered even more, with many plunging 10% or more. While the impact of Trump’s policies remains speculative, weak demand from European economies and China is likely to constrain global growth (and inflation). At the same time, a stronger U.S. dollar could weigh on corporate earnings for U.S. companies.

US CPI (white) vs. our inflation model (purple)