Bitcoin is Pumping – What’s Our Upside Target ?

Institutional Crypto Research Written by Experts

👇1-11) Bitcoin has surged by 4% since yesterday, aligning with our tactical bullish outlook. The cryptocurrency made a decisive move upward, breaking out of the symmetrical triangle pattern, which suggests that there could be further upside potential. The Bitcoin funding rate has shifted back into a premium, supported by a $1 billion increase in open interest. Given these dynamics, a straightforward strategy would be to go long on Bitcoin while shorting Ethereum, as Bitcoin's dominance continues to rise and its share of open interest consistently diverges in its favor.

Bitcoin Open Interest Share vs. Ethereum’s - Traders Focus on BTC

👇2-11) The Federal Reserve minutes were as dovish as anticipated, with a strong focus on the employment aspect of its dual mandate. The inflation target seems within reach based on the current economic data projections. A "vast majority" of FOMC members supported a rate cut in September, with several members even considering a July cut as a plausible option. This makes a rate cut in September almost a certainty.

👇3-11) Powell's upcoming Friday speech is expected to reinforce this dovish outlook, likely boosting risk assets like stocks and Bitcoin as monetary policy provides a favorable backdrop. The Fed's focus is shifting towards employment in its decision-making, with inflation data becoming less central, especially as CPI trends towards 2.5% over the coming months. Multiple rate cuts will likely be necessary to sustain the current economic expansion.

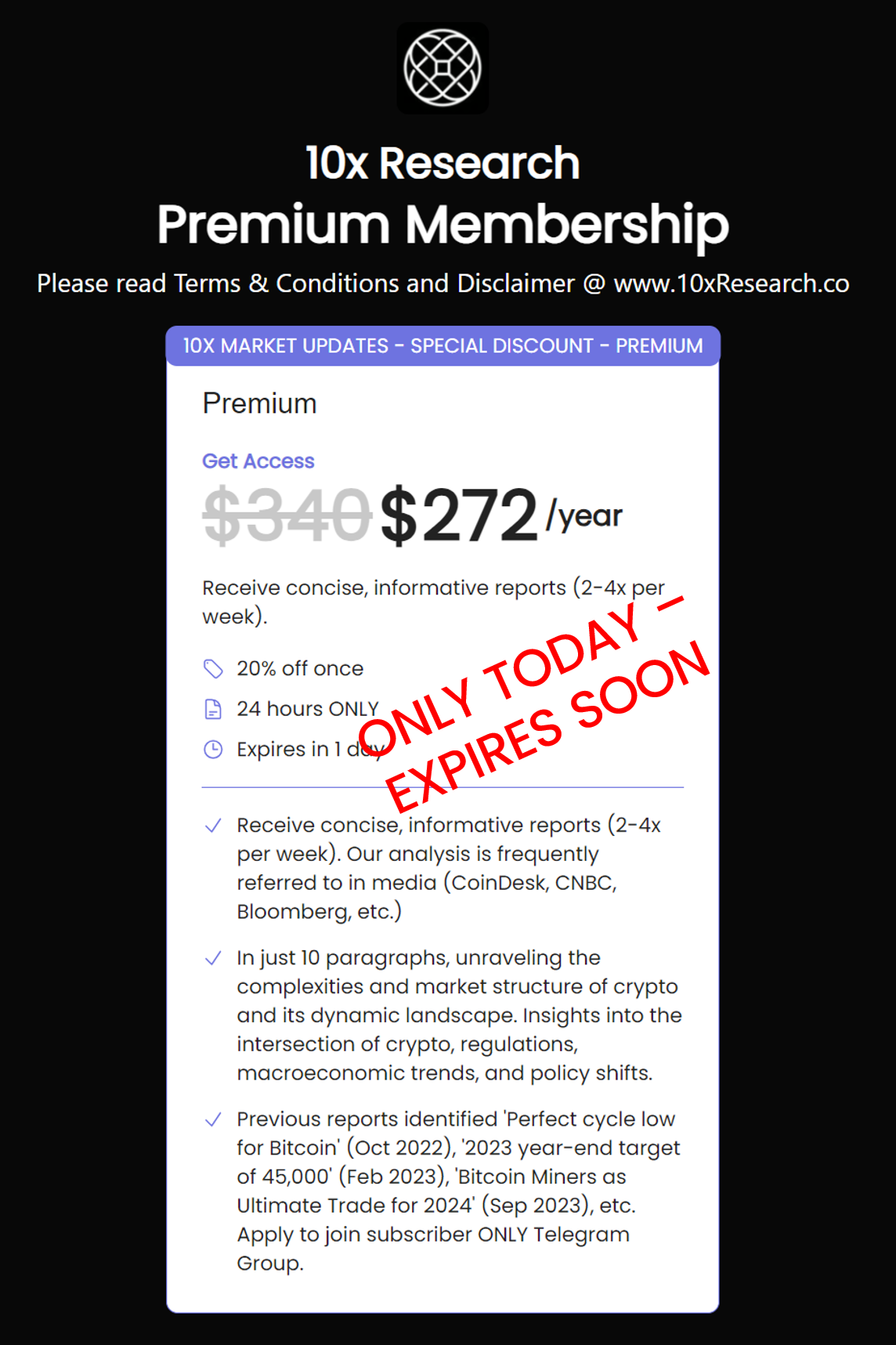

Special anniversary discount - expires soon - please share