Bitcoin is Better Than Digital Gold 💥

Helping EVERYONE to make better crypto investment decisions.

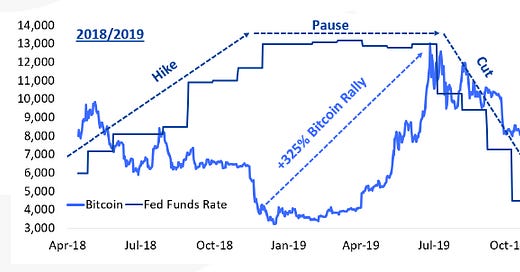

👇 1) In 2019, when the Fed finished its rate hiking cycle and paused for seven months, Bitcoin had a monster rally of +325% until global growth AND inflation disappointed.

Bitcoin when the Fed ‘paused’ in early 2019 - The Fed has paused since July 2023

👇 2) Another timely report from us. This report, written before the attacks on Israel, explained why Bitcoin is even better than Digital Gold.

👇 3) This report was quoted in 390 media outlets and is gathering additional interest after billionaire hedge fund manager Paul Tudor Jones said that he likes Bitcoin and Gold – similar to our report, he acknowledges the dire US fiscal situation.

👇 4) Year-to-date, the price of gold is up +1%, while Bitcoin has recorded an impressive +66% increase.

👇 5) The August 2017 hard fork brought about a critical decision to the forefront: Should Bitcoin evolve into a transactional blockchain resembling Visa, capable of handling around 1,700 transactions per second?

👇 6) Or should it remain a finite digital asset akin to gold, retaining its limited block size and scarcity? There is a striking association between the pseudonymous creator of Bitcoin; Satoshi Nakamoto, and the ownership of gold.

👇 7) Bitcoin’s market capitalization is $540bn, equivalent to 10.8% of the market capitalization of physical financial gold. This is why a potential approval by the SEC of a US-listed Bitcoin ETF could usher in a monumental inflow of $20-30bn, potentially driving a significant surge in Bitcoin prices.

👇 8) When Satoshi Nakamoto published the Bitcoin whitepaper, the US public debt as a percentage of the gross domestic product (GDP) was around 64%. Historical analysis suggests that when a nation’s debt-to-GDP ratio surpasses 70%, the burden of debt service payments begins to overshadow economic investments, and a country's fiscal health declines.

👇 9) An inverted US yield curve often predicts an impending recession within a few quarters, though this is yet the case. In parallel, the contraction in money supply (M2) has been negative year-on-year, suggesting a potential reduction in US inflation by the year’s end and beyond.

👇 10) In 2019, when the Fed finished its rate hiking cycle and paused for seven months, Bitcoin had a monster rally of +325% until global growth AND inflation disappointed. At present, the most critical macroeconomic factor appears to reflect the situation in 2019 when the Fed paused its rake hikes, leading to a significant surge in Bitcoin prices.

How China and Hong Kong became the number 1 crypto destination -> read more in Crypto Titans: How trillions were made and billions were lost in the crypto markets https://amzn.to/3LZ6E6J